A Day Trading Journal Towards Financial Freedom

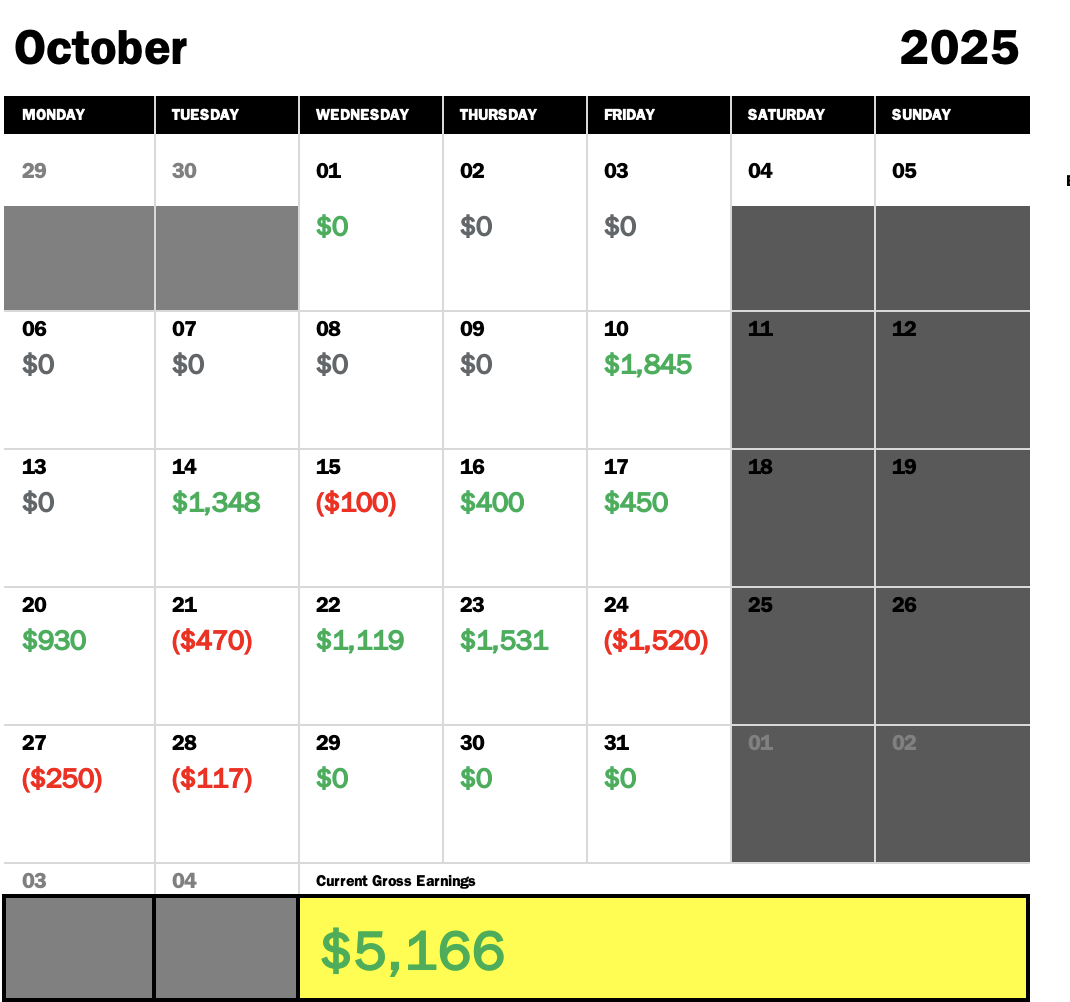

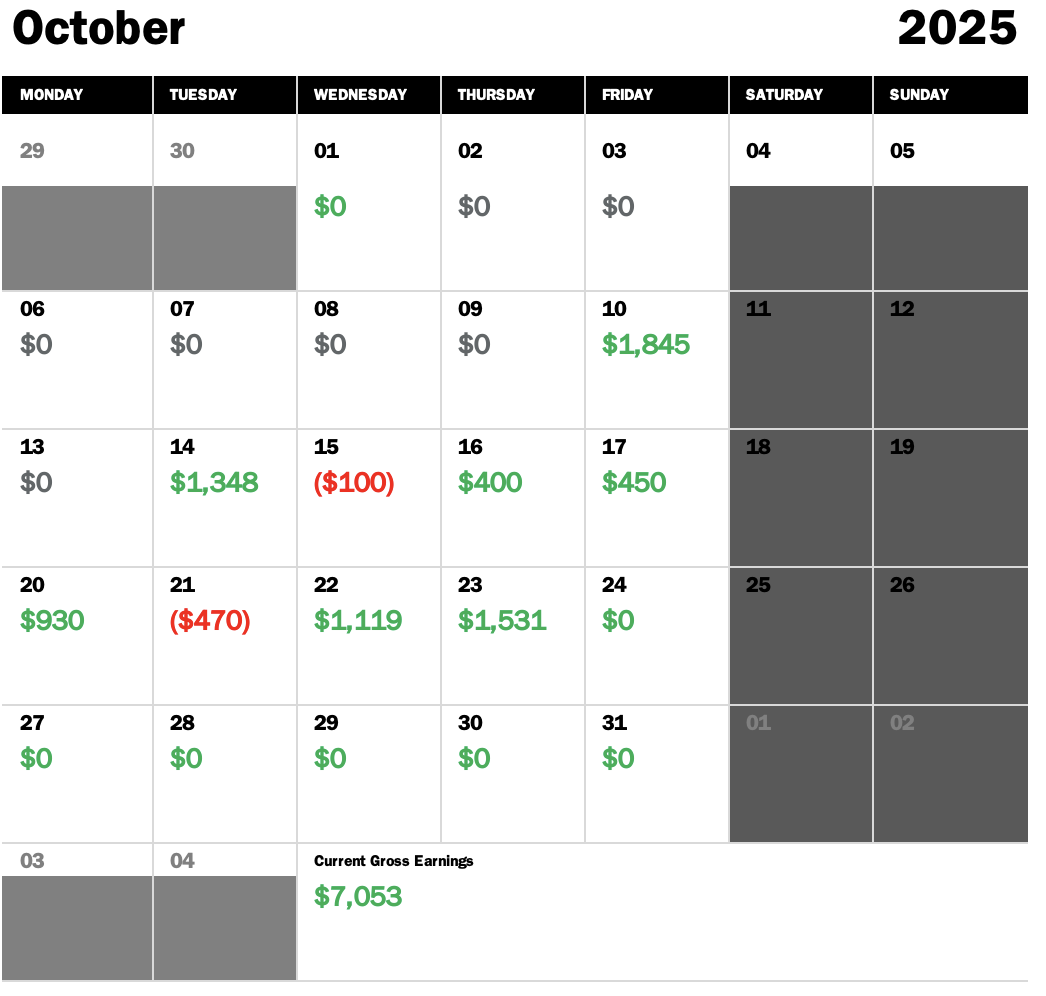

Summing up October

We are ending the month almost breakeven. A bit better than September.

A lot of traders also had a difficult time trading the month, although, comparisons will not improve anything. I felt that there was a lack of continuation during the intra-day movements whether to the upside and downside. If I were to look back at this month, the last two weeks were not meant for options trading for SPX. For individual stocks like TSLA and NFLX that had clear trends, yes. But SPX option premiums were melting like they were next to the sun, giving you false hope even if your bias was correct.

I keep on underestimating the time decay attached to an awful market. My results were pretty much the same for September and October where I do amazing during the first three weeks and then do something stupid at the end of each month to ruin all my gains. September, I was up $13,000 and did something stupid.

Moving forward, I need to tweak my strategy. Find clear bull and bear flags, add on proper pullbacks and go in with small size.

I also need to practice looking at higher timeframes for my entries, but I haven’t really found the “aha” moment when it comes to that. I usually trade on the 2m, with 5m and 15m as my bigger timeframes. But now, I’ve been trading with 5m, 15m and 1hr and I think I’m starting to get better at it.

Hopefully, I can gain back all my losses in November and December, about $17,000 to bring me back to square one. Hope Santa will arrive early and shower me with blessings!

Hello Folks.

Yes, I know it’s hard to digest what you are seeing, I lost $4,140 today. While my thesis was correct, because of time decay, I lost that much. I told myself that every end of the month, there’s always something that happens where I ruin my stats. I don’t know why…

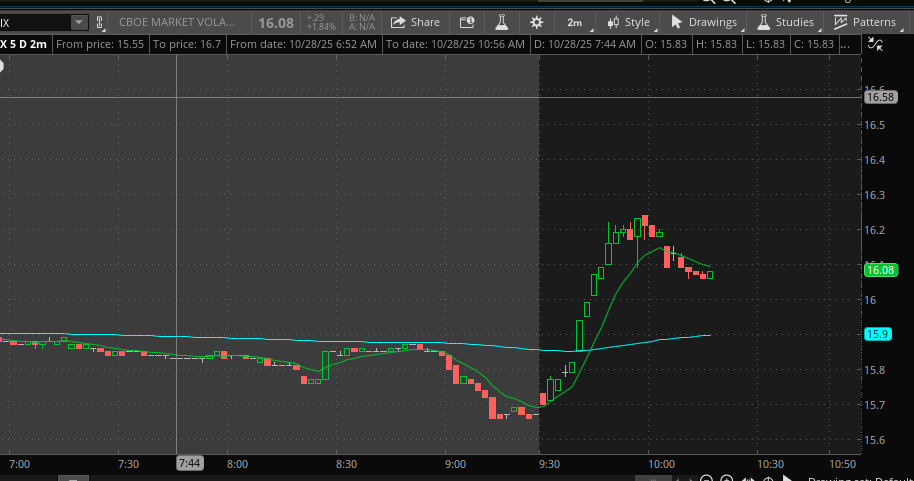

My analysis for today: Market was a bit weak. My bearish bias was strengthen by seeing VIX somewhere around the 17 area during pre-market. NQ was following ES as having a weak pre-market.

The open started and I followed my usual 5m ORB. the second candle broke down and that is where I entered my trade. I bought two put contracts and was up $340. Thinking that there was follow through, I added 2 contracts more. The price kept dropping and added 2 more. I was anticipating that SPX will finally fill the gap that i plotted days ago during the first hour of the day and reverse once the gap has been closed. But I was wrong. The price dipped just to touch the top of the gap and it reversed. In shock, I couldn’t press the sell button, because of how much instant drawdown I experienced. And then, I broke my trading plan… I added more to a losing trade, which now brings me to 8 contracts. The market kept moving sideways for most of the day, but I was seeing something from the screen—weakness in the price action going up. So i stuck with my position. I told myself that as long as ES will not go up pass 6915, then I see weakness. Lo and behold, during the final hours of the market, it broke and headed down to half of the gap. at that point, from a -$3400 drawdown, I got it back to about -$900. So I told myself, maybe there is continuation for tomorrow and I will hold this till tomorrow.

I forgot one thing. This week is earning season.

AMZN had stellar earnings and it saved the market. It saved ES. My premiums went from $5, back down to $1.60. What did I do!? I thought I was over this already. :|

When you think that you can outsmart the market, then it does something like this to remind you that it’s in control. A pricey lesson to be learnt. But then again… my thesis was correct, just not my P&L. hahahaha.

Hello Everyone,

FOMC day today! What a wild price action towards the end of the day. Well, I was able to break from my red day streak by trusting (temporarily) the bulls to take us higher. It proved to be useful until it wasn’t.

First up, NVDA. Nividia popped from 207 up to 212 today. I jumped with two call options at around 210 area with a stop loss at 209.34. Looking at the 5m chart, it was going my way, all the way to the 212 area. I was up about $170 on my calls but didn’t sell. If you look at the two long candles, while the second one was forming, it looked like it wanted to go pass 212. unfortunately, it started to weaken, and I sold for a small loss.

Simultaneously, I entered a trade on SPX following ES. I had some good entry and kept adding to my position. I didn’t realize that my top or last purchase was 4 contracts. When I saw what had happened, I told myself that once it goes back down to my second entry, I exit no matter what. There was no follow through to the upside, and I had to cut my trade from a $700 profit, down to around $200+. But at least, I was protected. Apologies, but I didn’t realize that I wasn’t able to get a screenshot of my trade.

I saw that VIX was climbing up and was scared that my calls were gonna burn, but I persisted. I told myself that if VIX went up to 18-19, then I will be very cautious and probably sell my position at loss.

During FOMC, ES and NQ produced a super nasty red candle. But while listening to Powell, I realize that it might just be an overreaction when he mentioned that a December rate cut might not be necessary. I saw that ES hit yesterday’s high and reacted, around the 6900 area. If you can see my entry, I entered around 6896 and rode it up to 6908. I sold, and after, price action started to get sloppy. I was happy to have secured even just a small profit.

I am still cautious of longing because even with the quick drop, SPX hasn’t covered two gaps below. Those are some tasty short opportunities with high conviction. Hopefully, when that happens, I will be on the correct side of the market and short to oblivion. I am trying to hit a $9000 day… I know it’ll happen!

Hello Everyone,

Happy Tuesday! My red day streak continues. Although, if you notice, I have been losing less. I may not be aligned with the market right now as I am mostly inclined to shorting will we are ripping like there’s no tomorrow, but my risk management has improved tremendously following a tweak that I did to my trading plan.

Today, I didn’t have the business to short TSLA while its rallying up. I don’t know why I was doing it, thinking that it will not get pass $460. I was wrong and I admit that.

Tesla is a stock that I normally don’t touch, or have stopped trading after it did a stock split 2-4 years ago. What’s funny is that when I closed my trades on tesla, I didn’t realize that there was still one open put position that was bleeding. By the time I was able to close it, my premium had gone down $2-3 from where I had purchased it.

On the other hand, SPX…

Well, I had another fake out. First five to ten minutes looked weak, and I was trying to short it. I was looking at VIX and it was somewhere around 15 or 16, climbing up when I took my short trade, giving me confidence.

At one point, I was up $700. I should have sold, but before I could even close my position, a huge surge of volume entered and cut my profit. From then on, SPX climbed even higher. This is something that I need to work on. I always catch myself being part of a reversal, on the wrong side.

Note to self: don’t short a strong bullish market.

Hello Everyone,

I hope you had a good weekend. Worked allowed me to feel the weekend go fast so we can trade again.

Today, I didn’t really feel like trading, I was half-hearted on even opening my ToS but I still did since I knew that there was good news over the weekend regarding Trump and China.

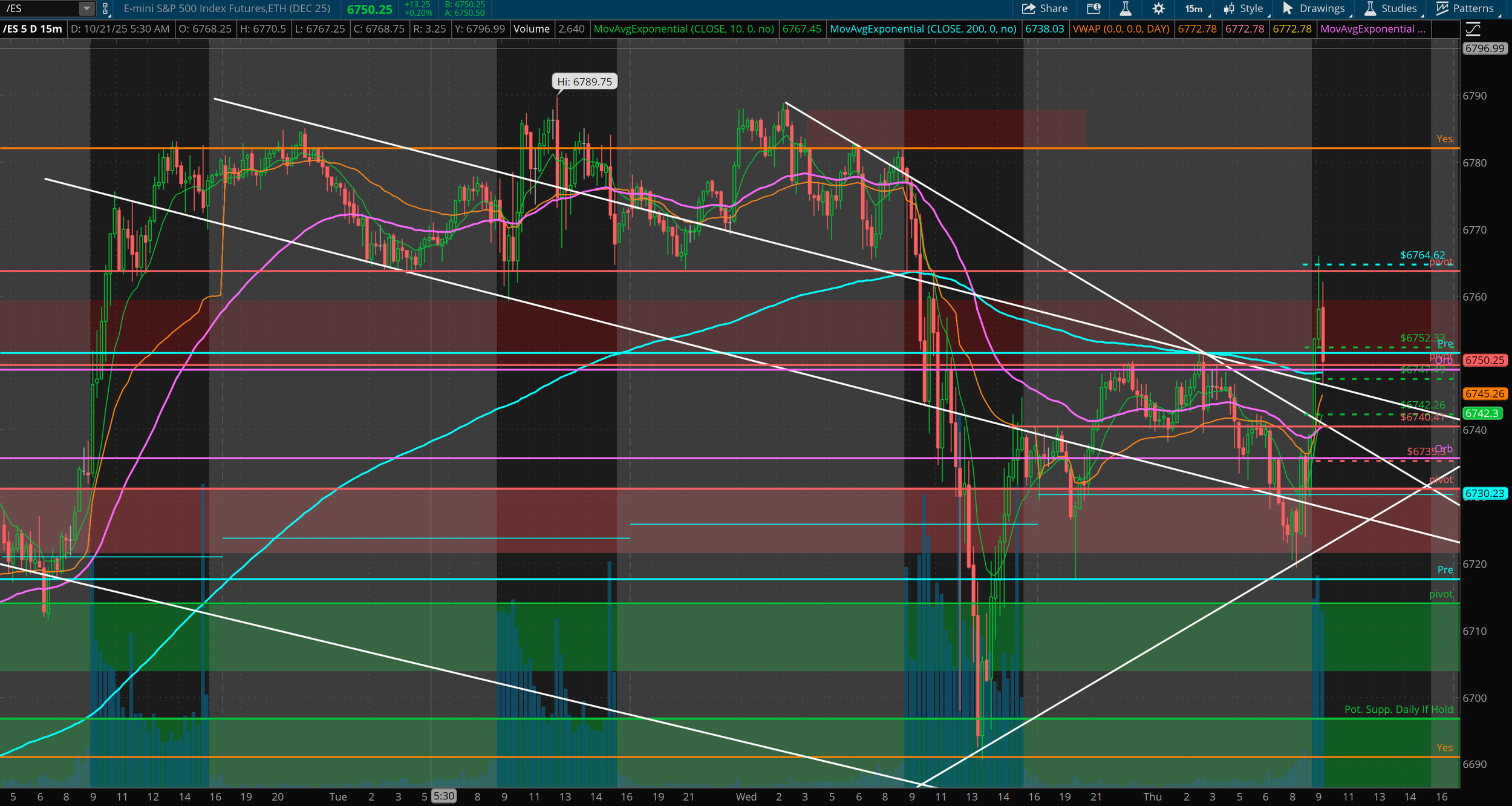

Analysis: When the pre-market started, there was a huge gap, reaching a new ATH. But I was worried about the potential that SPX and /ES can fill that gap.

The session started and I didn’t participate for the first 25-30 minutes. I was expecting an ugly price action, which proved me right. Using the 5m chart, the market was moving sideways. I plotted my 5m and 15m orb. Up to around 10:00am, I saw ES pushed up, breaking the orb. Me, thinking that it will continue, put in a call contract, I wasn’t so sure about the move so I didn’t want to risk a huge position. When it hit my stop loss, I waited and re-entered. The movement took me up by only a little until it failed again. After two losing trades, I told myself that I will stop trading and just focus on work.

Another interesting observation about ES lately is that whenever there is an ATH forming, the market just trickles in a range, but the overall movement is to the upside. There’s not a lot of volume, hence the ugly price action. Although, the afternoon offered an opportunity. From where I traded my contracts, it went up from $4.40 all the way to $13 near the closing bell. I should keep an eye on that next time, knowing that there is follow through. But will it be worth to sit down the entire day to anticipate such a move? I guess not.

Hello Folks!

We gave back yesterday’s profits today, unfortunately. CPI data report came in today, and I thought we were headed for some more upside action. Coming into the session, ES posted a new ATH during pre-market. But after the strong bullish candle came out, it started to fade back down. I saw that as a sign of weakness since it is an unknown territory and market cycle is still a part of the “bearish”sentiment for the month.

What I did upon open is to wait for the first five minute candle to form to get a grasp of where the market wanted to go. It signaled a bullish candle and I entered my first call option. I was able to sell with a $70 profit. I again re-entered, now with two contracts, with different premiums. I got stopped out. I was probably down -$120. When I notice the wicks forming on top, I started to switch my bias to bearish. I entered another trade around 6825, with the stop loss a little bit over the pre market high of 6837, giving the ES a lot of room to breathe.

Also, like I mentioned before, there is a huge gap on SPX, and that normally leaves the index to come back down to that level to fill the gap. This gave me a stronger conviction for the bulls to be faked out with this strong movement to the upside.

I began adding to my position until I was 5 contracts deep, shorting, while ES was falling, promising for continuation. I noticed that ES was struggling to penetrate the resistance from 6824 area, giving me a stronger conviction that it will go down. My last entry was 6820 until a huge candle suddenly showed up, bought the dip and took ES back to the upside. I suddenly realized that ES really haven’t broken the range and we just chopped pretty much the whole day, while still headed up. But then again, anybody who traded options today probably got their premiums raped due to the sideways action.

I am happy to have followed my strict stop loss levels. One thing I overlooked at is that when a trade goes against me, while i’ve entered 2-3 positions already, is that I need to cut my losses or take profit when the price goes back to my 3rd or 2nd entry point, allowing for minimal loss.

But it’s ok. we there’s still 5 more days remaining for October and hopefully we can recoup losses and end up with at least $10,000. Fingers crossed!

Hello Folks!

We are taking home a good $1531 today from the market. My thesis and analysis of the price action rewarded me with a really good trade, execution was top-notch and clean—breaking to the upside, having 3 different entry points and sold mostly at the top.

As usual, I plotted my lines and levels, I apologize for having a really dirty pre-market chart today. BUT hear me out! Those trendlines that I plotted are where the prices touched or visited, thus giving me the confidence to follow the upside move. The opening 5 minute candle today was wobbly, it couldn’t decide where to go, at one point it was green, then red, then green again. The second 5m candle did the same thing, but one thing I noticed though is that it closed above my trendline, hence taking the first trade at 6742, with a stop loss at 6740. As soon as I bought, the market rallied. I kept on adding and adding until I had about 4 contracts, which was plenty enough to bring me good profit while maintaining less risk. I sold around the 6764 area, maximizing and squeezing out most of the juice from the call premiums.

I kept on watch NQ, VIX and even QQQ. NQ and QQQ were following ES, trending up while VIX stayed dormant at 18 or less. SQQQ (reverse) was down.

After banking about $1,770, I took a couple of small trades on NFLX hoping it will start to bounce up, and 1-2 trades on SPX again, anticipating a rally after forming a bull flag, unfortunately, I didn’t want to wait too long as I am about to start working and just sold for smal losses.

Happy to have made this profit today. We are up $7000 for the month!

Today, I noticed that SPX didn’t have any gap to fill, thus creating a thesis that price will move smoother to the direction of the trend. Since the market sentiment is on the bull side, after following the news regarding Trump’s Tariffs on China and seeing that both ES an NQ futures are strong, it was a no-brainer to just trust the bulls.

Normally, when SPX opens with a gap, it wants to fill it, so the tendency is for the price to fill that gap and bounce off of that point for a reversal.

SPX Observations