Greetings Everyone!

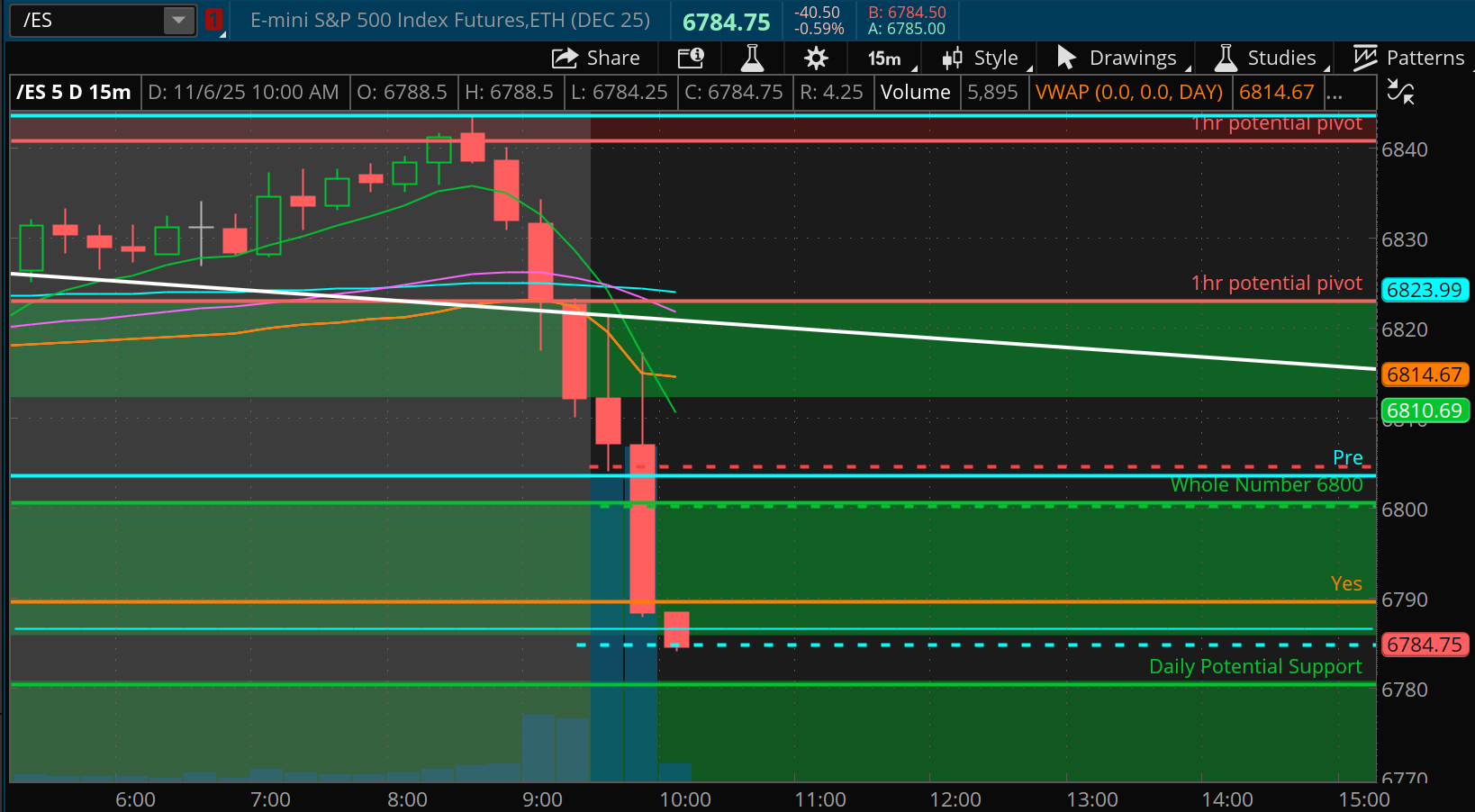

Summing up November 2025.

Today is December 12, 2025, Friday. This is a late journaling on my end, mainly due to frustration of my losing month and wanting to take a break from the charts. First off, my wife and I went to Peru for a nice reset and to immerse ourselves in a different culture. I love Peru and can’t wait to come back and visit Machu Picchu and Cusco. Anyhow, I did trade my Lucid account while there. I want to give you an update regarding my progress, or the lack thereof. When I purchased a Lucid prop firm 50k account, I was able to pass it. It was instantly transferred to a funded account but it didn’t last long until I blew it up. Towards the end November, I never really traded my own money again.

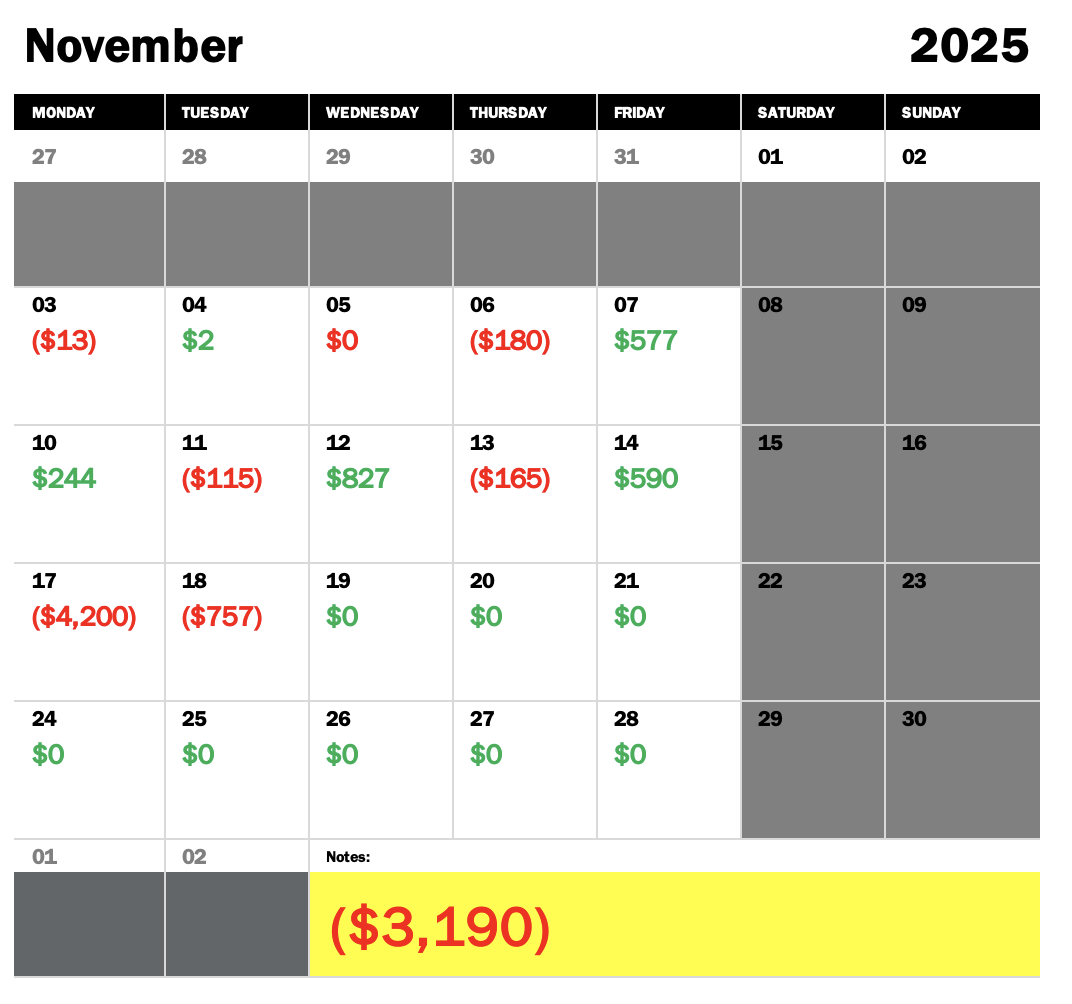

This is where we end up with a -3190 for the month.

I posted something on X saying that despite still being $10,000 in the green for the year, I am admitting defeat in trading because I can’t get pass my casino mindset of just gambling away my money once I get on tilt. It’s a huge adversary for every trader to convince themselves to step away from the computer once you’re on tilt. Also, I know that trading on your phone is not the best way to be ahead of the curve. I am a fan of checking my ToS app on my phone and sometimes, I get FOMO’d and trade through it, rather than being behind my computer where I have my proper set up.

I have been creating expensive mistakes that costed me about -$30,000.

As of now, I have generated $65,000 in trading revenue and -$55,000 in losses. I lost -$30,000 in just 4-6 trades.

Greetings Everyone!

Continuing my losing streak.

11/14/25

Today’s Feeling / Emotion / Mental State:

Analysis:

Tesla was selling off tuesday. This was an overnight trade that I took on tuesday and sold today. At one point, I was up $800 already, but thought that it has more room to head down. Tesla gave me a couple of chances to get out in the green but refused to do so. Until in the afternoon, where the markets started to got sick of being shorted and reversed. Oh well. I think I’m on tilt.

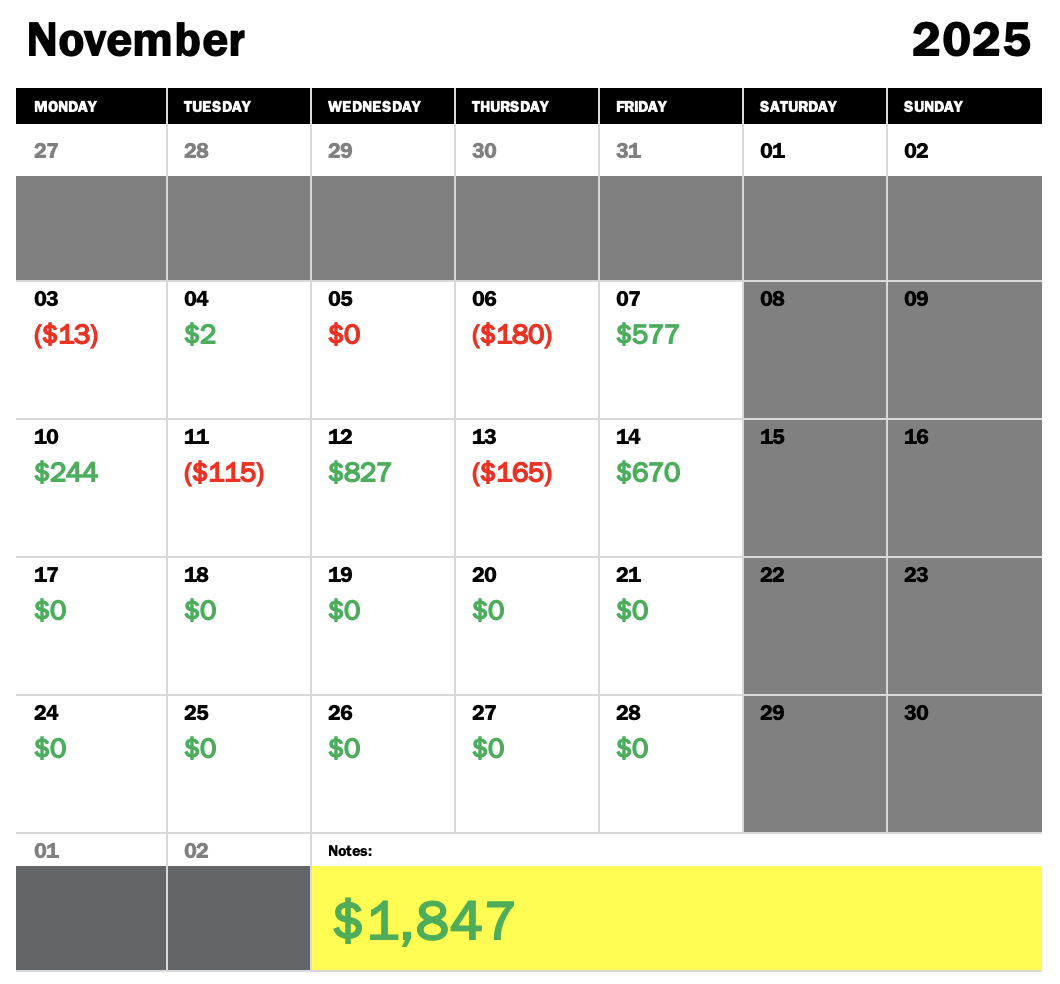

Starting today, I applied for a Lucid trading prop firm account and will try to pass the evaluation. I need to get to a $3000 profit for a 50k eval. So far, I did $1,124 today and will have to do about $1000 a day to pass. Hopefully by friday, I’ll be able to pass my account and start getting payouts. I will try to transition from using my own money to only using prop firms.

I really love day trading and see it more valuable than my hospitality career. I see my near future transitioning to a full time trader. I know it will happen and I’ve made progress this year regarding the way I see the market, when i’m behind my computer.

I will resume journaling once I pass the eval account!

Greetings Everyone!

I suffered a devastating blow that buried me into a deep grave. This reminds me of how I need to avoid trading on my phone. It makes it so convenient to the point that you become blind of what you should be doing. I wish I can go back in time and avoided this trade completely. By the time I realized my mistake (while still having just a -$75 drawdown) it was too late.

Here’s how it came about. Friday, 11/14/25, after ending the week in the green with my NFLX trade, I flew back to Miami. I got to my usual routine but didn’t realize how the time difference, despite only being an hour, would alter my emotions, state of mind and mental clarity.

I was happy and fulfilled on saturday, while spending time with my wife as we watched a comic do a stand up here. Sunday, I joined Vincent Desiano’s 3-day free live-trading event. It was in preparation for Monday’s market.

Today’s Feeling / Emotion / Mental State: Despite sleeping early, I woke up a bit tired, adjusting to the change in time. I didn’t trade during the morning as I told myself that I would rather just watch Vincent trade. It was very informative, as he makes it look so easy. I went to Costco this morning and had to change a tire, while still watching the mentorship. at about 1:00pm, I went to work and this is where everything started to unfold.

Analysis:

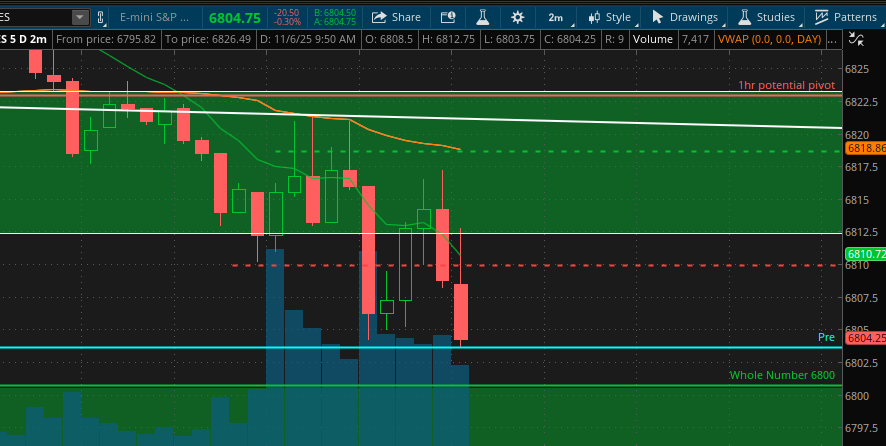

ES opened heading up but failed to hold 6770, then making a drop to 6720, then headed back up again. It was pretty much a choppy and slow trading session. At about 2:00pm, while it was making a relief rally back to 6770, I was anticipating a continuation to break a declining trend. I took 15 call contracts on SPX about 6760 ES level, that I would say, was almost at the top. Those calls didn’t last long until it started to melt. after a couple of minutes, the market started to move big and went against me. I checked SPX and I got trapped on top of the declining trend. I couldn’t believe it and was hoping that the price will at least just retrace before finally heading back up. I didn’t put a stop loss since I was trading on my phone, which was so foolish.

This is a lesson learned.

Losing money this much doesn’t sting me anymore, although what I really feel bad about is that I lost discipline to cut my losses. My position was way too big for me to tell myself that I still need to follow my mental stop loss, which I didn’t.

Greetings Everyone!

11/13/25 I traded yesterday but didn’t have the time and forgot to journal, as it was my last day at work. It’s funny because I took a long when the market wanted to go down. I was up about $475, secured, while I allowed my other contracts to breathe. Unfortunately, I didn’t realize that I bought almost at the very top and allowed my gains to be depleted and sold the rest of the contracts at a small lost of -$165.

11/14/25

Today’s Feeling / Emotion / Mental State: Slept early at around 9:00pm and woke up amazing. I’m headed back to Miami today after three weeks of being away. I love my mobile set up as it allows me to trade anywhere as long as there is high-speed internet! I have a very positive outlook in life and I know that blessings are coming my way.

While trading: I didn’t feel any palpitations or heightened emotions. I guess my trade on NFLX was an obvious bias that I just had to jump in. I need to find set ups or trades like this more often. Only SPX gives me the chills. hahahaha.

Analysis:

NFLX was struggling pre-market to break a certain level, which is around 1150. Upon open, the stock dropped and I took advantage of the opportunity, entering the 2nd or 3rd candle while looking at the 5m. I entered a trade at 1132, with a stop loss at 1145 for five contracts. First out was at 1124 of 4 contracts and 1 at 1119. From here, it kept going down to 1110, which was initially my traget price, but I just lose conviction to keep on holding most of the time, fearing a reversal. I was looking at ES and NQ and they were reversing to the upside. Also, VX was going down, despite still being above 21.

on SPX, I took a small trade to the downside after ES rallied to the upside. I was figuring that it might still have more room to go down. The futures was trying climb up. to 6730, but failing to hit the number. Although, once I saw the bid print 30.25, 30.50, 31, I sold happily with a small loss.

Im done for the week and I hope you have a good weekend.

Greetings Everyone!

Today’s Feeling / Emotion / Mental State: Slept and woke up amazing. Still counting the days on when I will get back to Miami. But anyhow, I don’t see anything that will cause me to go crazy and feel less than spectacular. My mind was clear, positive outlook in life and can’t wait for our upcoming trip.

While trading, I noticed that my heart began beating faster than normal, caused by trading with a big position. I need to be accustomed to this feeling and remain calm during drawdowns.

Analysis: I’ve been looking at the market and noticed that there hasn’t been a significant retracement, ES has been rallying for 4 straight days. I took that as a sign that the market might pullback a bit before trying to reach ATH. Also, there’s the looming government reopening and I thought that it might cause uncertainty in the market.

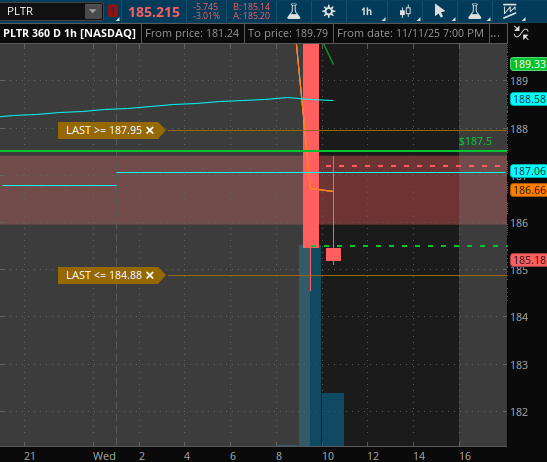

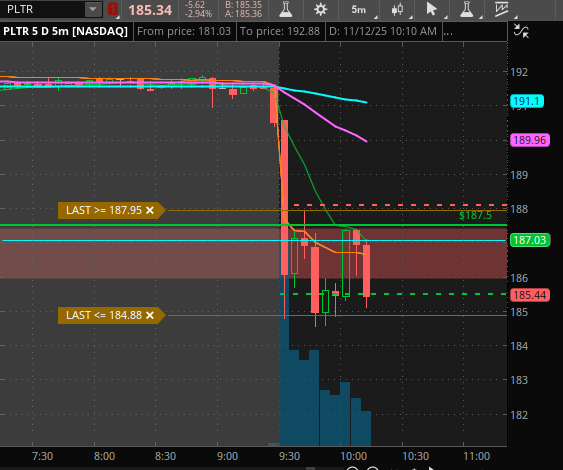

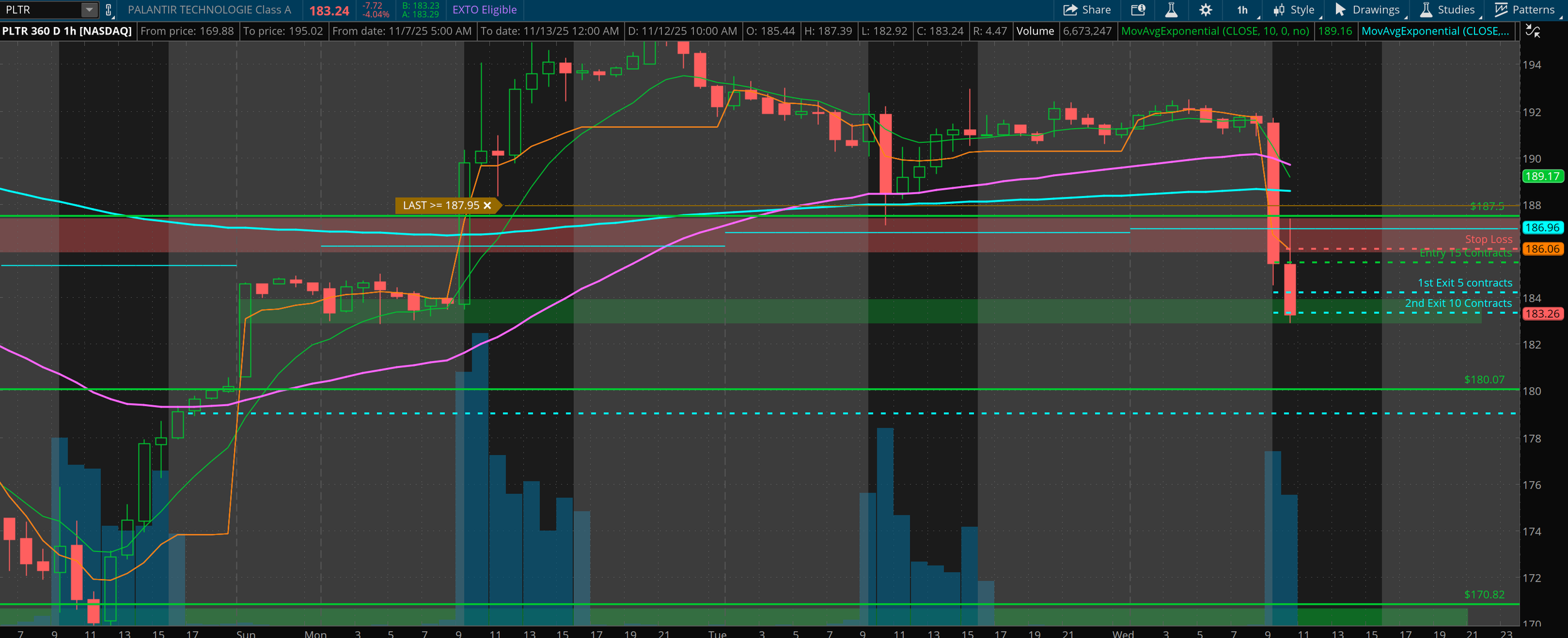

I took a trade on PLTR because the macro timeframes were looking a bit weak, it had hit the $190’s again. for a relief bounce from ATH of $222, but it’s been struggling to get back there since. The next pull of liquidity seemed to be from the 178-180’s, bouncing off from there. Also, Michael Burry is short on PLTR…. Lol. That’s why!

*As of writing (to finalize my journal), about 9:49pm EST, PLTR went all the way down to $181 intra-day, closed at $184.17 and is continuing to climb back up after hours. I think we have created a solid higher low at this point, despite Michael Burry being bearish. PLTR has now the ammo to climb back to the $200’s.

Trades: I’m not gonna put the analysis on SPX trade because it was just for 2-3 minutes before I realized that the sentiment was to short, selling my calls contracts without that much pain.

For Palantir, I was anticipating a continuation to the downside coming from the 186’s. Again and again, I need to remind myself to find better entry points. I got FOMO’d and the stock reversed on me temporarily before giving me my much wanted resolution. I entered on the 2nd 5m candle and almost got stopped out. My drawdown suddenly blew up to -$1010, but kept my conviction that as long as it doesn’t hit initial stop loss which was at about 187.5-188, then I should be fine.

The price, despite giving me a bit of a cold sweat while it was relief-rallying, didn’t hit my stop loss. I was also noticing that there were wicks forming at the bottom of the candles, causing me to doubt a bit. At one point, I thought I entered the wrong trade because there was a potential double bottom forming on PLTR, but finally, after a long battle, the bulls gave way for the bears to just hammer it down. Once the price started to move in my favor, I began switching my stop loss to be tighter, I sold my contracts while scaling out.

*As of writing, 9:49pm EST, I observed that from my purchase price of $2.39 / contract, It went all the way up to about $4.50 / contract. I sold too early at $3.10-3.16, fearing to not lock in profits and have the stock reverse on me.

Greetings everyone! Happy Veterans Day to those who have served our nation. Thank you for your service.

A small loss today, following up on my idea to not really focus on trading. I took a quick trade on SPX and lost a small -$115.

Greetings everyone!

Not much happening today on my end as work pulled me away from being able to sit down and trade properly. I had a party of 325 plated lunch plus a kitchen altercation between cooks that I needed to neutralize. Hahahaha.

But anyway…

Today’s Feeling / Emotion / Mental State: I had a good sleep, although it would have been better if I slept early. I had a nap in the afternoon, and that kind of ruined my sleeping schedule, dozing off at around 12:00am, which is pretty late for me. I was able to get out of the hotel yesterday, sunday, and explored a little bit of Louisiana, where I’m currently deployed, thanks to one of the sous chef of the hotel. I guess that gave me a sense of ease, calming my mind and preparing me for the week ahead.

Today, I have a clear mind, a positive approach to life, knowing that I’ll be coming back home to Miami in a couple of days. I miss my bed and my apartment!

Analysis: This week might be too challenge for me to trade, as I have most of our banquet events in the morning. My plan is to scalp the market, banking between $100-$300 profit per trade and take it easy.

Coming on to today, I knew that the market had a positive sentiment because of the government reopening. I was bullish as well, although, I didn’t really want to be involved with the market upon open. I waited until about 10:30 or 11:00am before entering my first trade, which was ironically, to the downside. I told myself that I want to see ES create a brand new higher low, anticipating a nice movement down before rebounding. My thesis was correct and was up about $300 at one point, but that turned out to be the bottom, before finally rebounding. Like I said, I was bullish, although I wanted a deeper retracement, filling the gap on SPX, that didn’t happen. When I saw that the bulls were waiting for the correct time to catapult it to the upside, I sold my contract. Good thing I did, for it went from $10.70 down to $2.50 towards the end of day. Not really much to note on this trade as my focus wasn’t 100%

For Netflix, I just took a quick scalp from 1120 to 1123 and took profits immediately. That is all for me today.

Greetings everyone!

Im finishing up the week in the green, despite having issues at the start of the month, following my huge loss towards the end of October. Maybe it is coincidence that after i moved my table closer to the window to get more light, things started to go back to normal, that means, printing money again. Or maybe… the market was just forgiving.

Today’s Feeling / Emotion / Mental State: I slept early the night before and woke up amazing today, at about 5:30-6:00am, Louisiana time. I did a morning walk for about an hour and covered about 13,000 to 15,000 steps. Before the session, I was calm and my mind didn’t set any expectation.

Analysis: Today was a one-and-done trade on CRWV. I saw news that Deutsche Bank is planning to hedge against AI stocks and this strengthened my conviction to short. Upon open, there was a huge sell off that lasted at least 30 minutes to an hour, which has been going on for about three days. Today, I took advantage of the sentiment and got amazing results. The price action was straightforward and easy, I couldn’t have asked for more. I sold my contracts at the best price levels, maximizing profit.

Let’s get to it.

VIX was unusually high trickling around 19++, and both NQ and ES futures were weak during pre-market.When VIX reaches above 20, that’s your sign that things are going to get volatile, take note of that. Upon open, I was watching CRWV failing to climb up pass $104.5, while simultaneously observing VIX, ES, NQ and NVDA. when I got confirmation from market leaders that price action was fragile, I jumped in. The trade had little to no drawdown, I had a stop loss at 104.17 and a target price of 100 first and then, 97 to 98.

What I’m realizing is that sometimes, SPX can be a bit confusing and challenging to trade. From now on, I will scan charts of different stocks to see which has the best set up so I can make easy trades on the daily.

That’s all for this friday, and I hope it continues until the end of the year. I need to still make back about $17,000 before I can say that I have been profitable for the year. I only came back trading seriously since July of this year, which gives me only half a year to assess my performance. Now that I’ve been journaling my trades, I hope it improves my overall approach. To more green days! Cheers and stay positive.

Hello everyone! I am laughing hard right now because the dry spell continues. If I can show you how I lost, made it back and lost again, you would laugh and scratch your head as well. I lost money because I moved my stop loss by about 5-6 points and the trend left without me. If I held on, I could have been a $500 day.

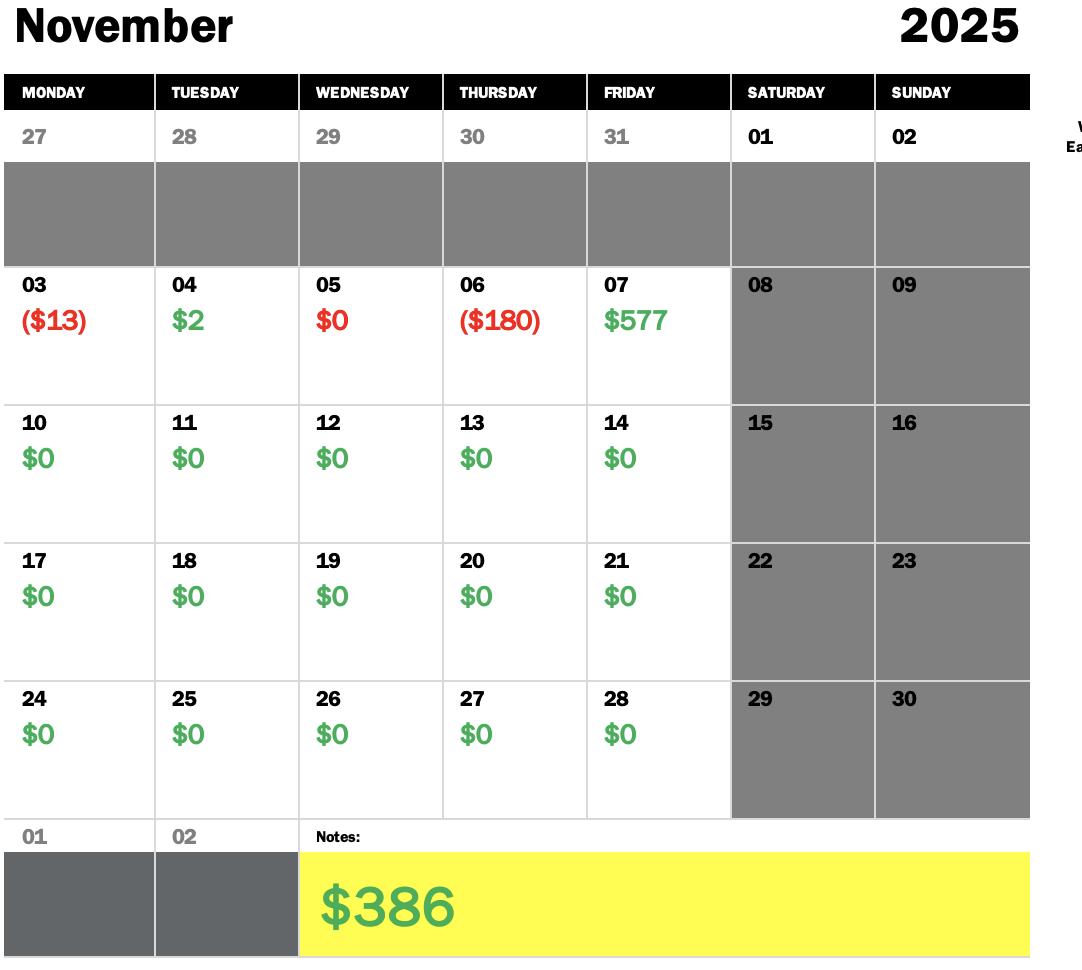

But without further wasting time, let’s get into it.

Analysis: despite the trend setting a bearish stance, I told myself that I will be long. And so I did, but it didn’t work. I was down -$360 on my first trade. The issue with today’s session is that I didn’t check VIX level before trading, to get a better grasp whether the market wants to climb or crater. HAHAHAHA. The only day that I didn’t do it… and I got screwed over. VIX started to form a nice bullish pattern during the first few minutes of the session, all the way up to about 18.8, and eventually climbed to even 20++. My first trade was from 6820, anticipating the break to 6825++, when it went the other way and hit my stop loss, I didn’t sell immediately. I thought to myself that maybe it was panic selling. It did climb up a little before finally heading down to 6804.

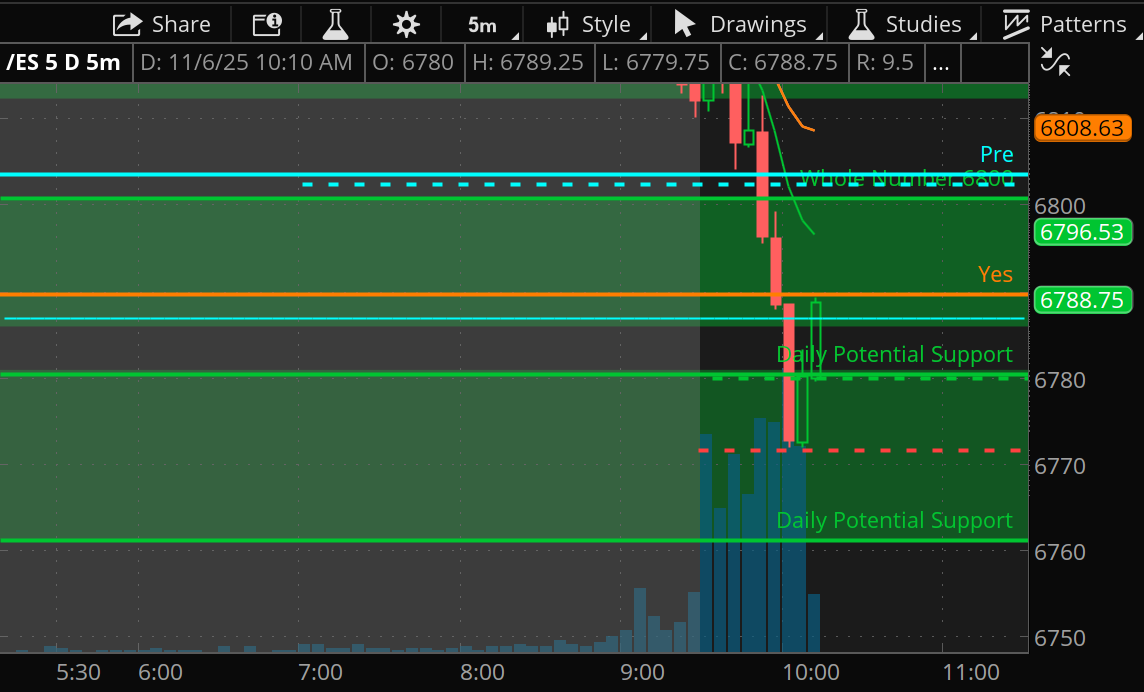

From here, I took a short and rode it from 6800, stop loss at 6810, just a bit above the pre-market low level, and sold it around 6790, allowing me to get back $300, and still down -$60.

My third trade was the anticipation of a reversal to the upside, seen on the fourth photo. I had so much conviction that i chose the proper entry. From my level at 6780, stop loss at 6769, ES rallied about 10-12 points, giving me two solid green candles. My TP was back to 6798. If you look at the last photo, I moved my stop loss and got stopped out by two ugly candles at around 6675, before going to my TP.

I don’t know what to say… It should have been an easy day. I don’t know what’s up. Maybe my headspace is not correct ever since I got here in Louisiana. I tried to move my table closer to my room’s window to see whether tomorrow will be different. Let’s see. I think I need to go back to Miami. hahahaha.

Until then!

Hello Folks!

Another breakeven day. Today was one of those days where I laugh at myself for wasting capital and energy—more importantly, giving back gains.

Analysis: Coming into Wednesday, I was anticipating for the market to rally up. VIX was weaker today, during the pre-market at about 18. It took me about 7-10 minutes before entering my first trade, with my ES level pre-outlined. It was the perfect trade, I must say. I bought calls at $6.80, ES level at at 6798, stop loss 6789, little to no drawdown, and rode it to about $11.40, a $460 trade. I should have stopped there, as I told myself. But… I saw more upside opportunity and got back in at $13.30, while it was consolidating. I was there for a good minute, waiting for resolution but eventually sold at $10.20. I then entered again, this time, at $10.70 and when I saw a huge red candle form, I let go at $9.20, breaking even for the day. Then, I saw that ES wanted to touch the level 6850 to draw liquidity, my premiums at the time of writing are now $22, with the cleanest, text book chart that you can ever think of. If I just entered properly and held on to them, today could have been at least a $1000 day.

I really feel disappointed about myself knowing that most of the time, I have the correct thesis, but I choke my options too much that it doesn’t have enough room to breathe and do it’s thing, trying to cut losses fast. I feel disgusted about myself for letting an amazing opportunity pass. Tomorrow is another day, I guess.

Hello Folks!

Another breakeven day. Walking into today, I was expecting a relief rally in the morning, which it did turn out to be. Although, the market rally faded and now, it’s beginning to be clear that it wants to go down. Let’s tackle today’s trades.

Analysis: First off, I noticed that the VIX was significantly high during pre-market, at around 20, signaling a volatile market that wants to go down. Although, I thought to myself to sit still and not trade at the open. It took me about 30-45 minutes before putting my first trade on TSLA. I jumped in on calls, 2, to be exact, from 457, anticipating a break of 460, to 462. I was able to sell the first one almost at the top, but let the other one run its course, until it hits either TP or stop loss. I bought another contract at around 458, but eventually, TSLA hit my stop loss and I ended up -$8.

Looking back, I am realizing that my initial thought of shorting was correct, I just didn’t have enough conviction to follow my instinct.

Next, SPX

When I saw that VIX went down when the market opened and saw that ES was pumping up, I told myself that the draw on liquidity will be at the yesterday’s low level. I took the chance and traded calls around the 6835 level with stop loss ata 6831, and it sure did work, briefly. At one point, I was up, but was trying to see whether there is continuation. I sold on the sign of rejection. I then entered again another trade, this time, puts. It turns out that that position could have been an overnight one to swing for tomorrow. I entered at 6830, with stop loss at 6837. And as you can see in the photo below, price action dumped from my level. I think i will wake up tomorrow and see the premium of that put explode from $2.85 purchase price to at least $14. Oh well, I guess that’s life.

I lost conviction on my trade and I’m paying for it.

Hello Folks!

We are now in November, how time flies. As a start, market conditions haven’t really changed, I can still say that options are not the best instrument to trade. This morning, I could have locked-in about $950 across three different trades, but unfortunately, despite having correct thesis, time decay and lack of conviction interfered with my trading. Let’s analyze all of them and see where I made mistakes and how to improve them.

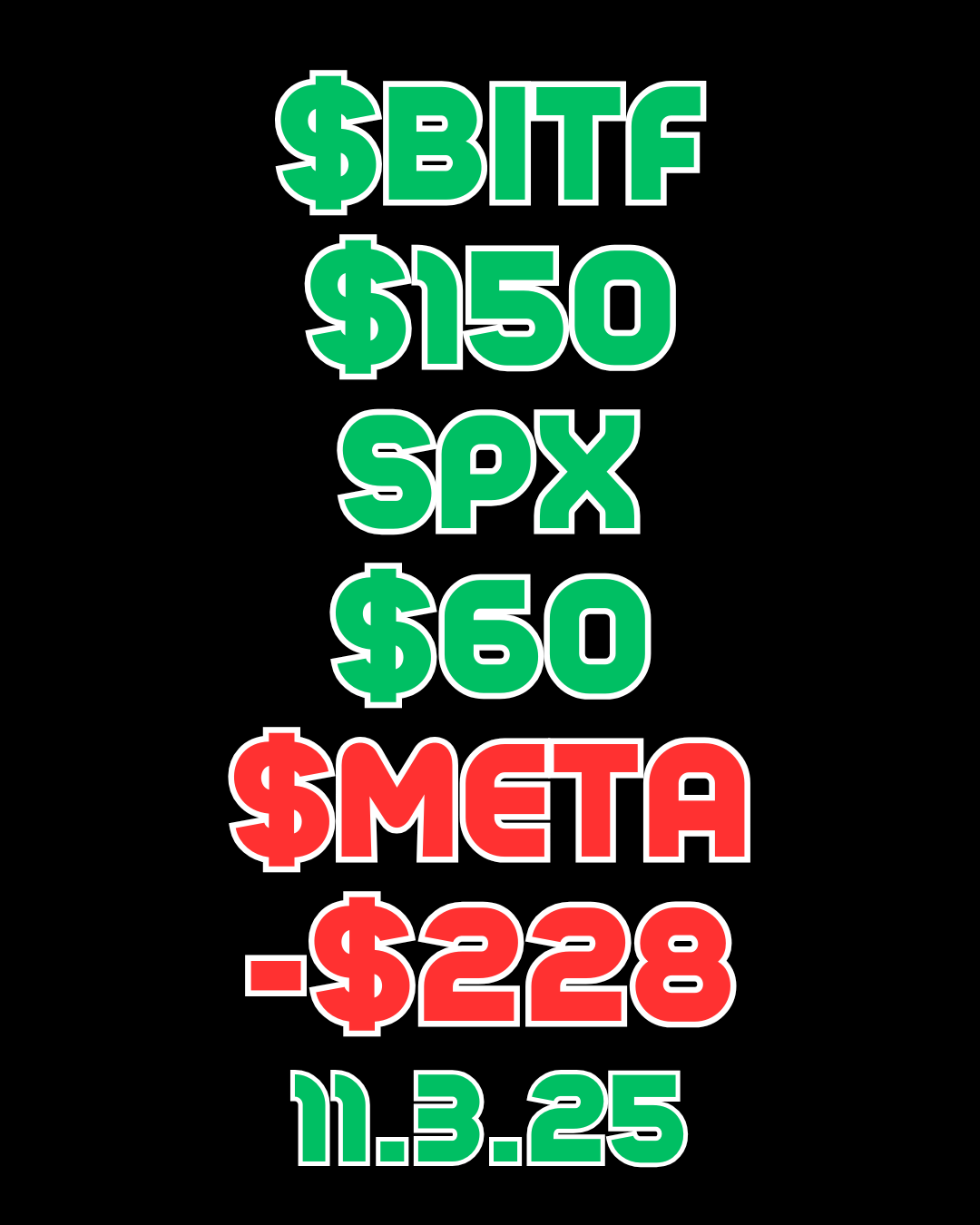

Analysis: To kick things off, I did an overnight trade on BITF. I ordered 15 contracts for the $4 strike price at around $0.57 a piece. BITF had a good pump in the pre-market. From friday’s close at $3.97, i had conviction that it will open strong at somewhere above $4 today. While it did open strong, as you can see in the photos provided below, it couldn’t get pass above my 20 DMA line and got stuck at about $4.55, not breaking pass that. At the highest point, I was up about $560, briefly. My average gain was somewhere around $430-460. I ended up selling at around $0.68 a contract or a total of $150. From the morning highs, BITF showed weakness that trickled down all the way to the closing. I should have locked-in profits and be happy about the $500.

Next, META.

I was anticipating a downside continuation with META, as the stock still looks weak after its earnings report where they are spending a huge amount of CAPEX for AI. That didn’t sit well with the market and had a huge sell off. If im not mistaken, this is the third day of the melt down.

I had a declining trendline that was proving formidable, as price couldn’t break through it. When the market opened, I saw a strong action to the downside and jumped in right away, until it reversed on me and produced some green candles. I took the loss at ended up losing about -$228. But then, in the afternoon, it started to sell off and my contracts jumped to $6.25 compared to my $4 purchase price. This could have been a $600 trade if I held on to it.

Lastly, SPX

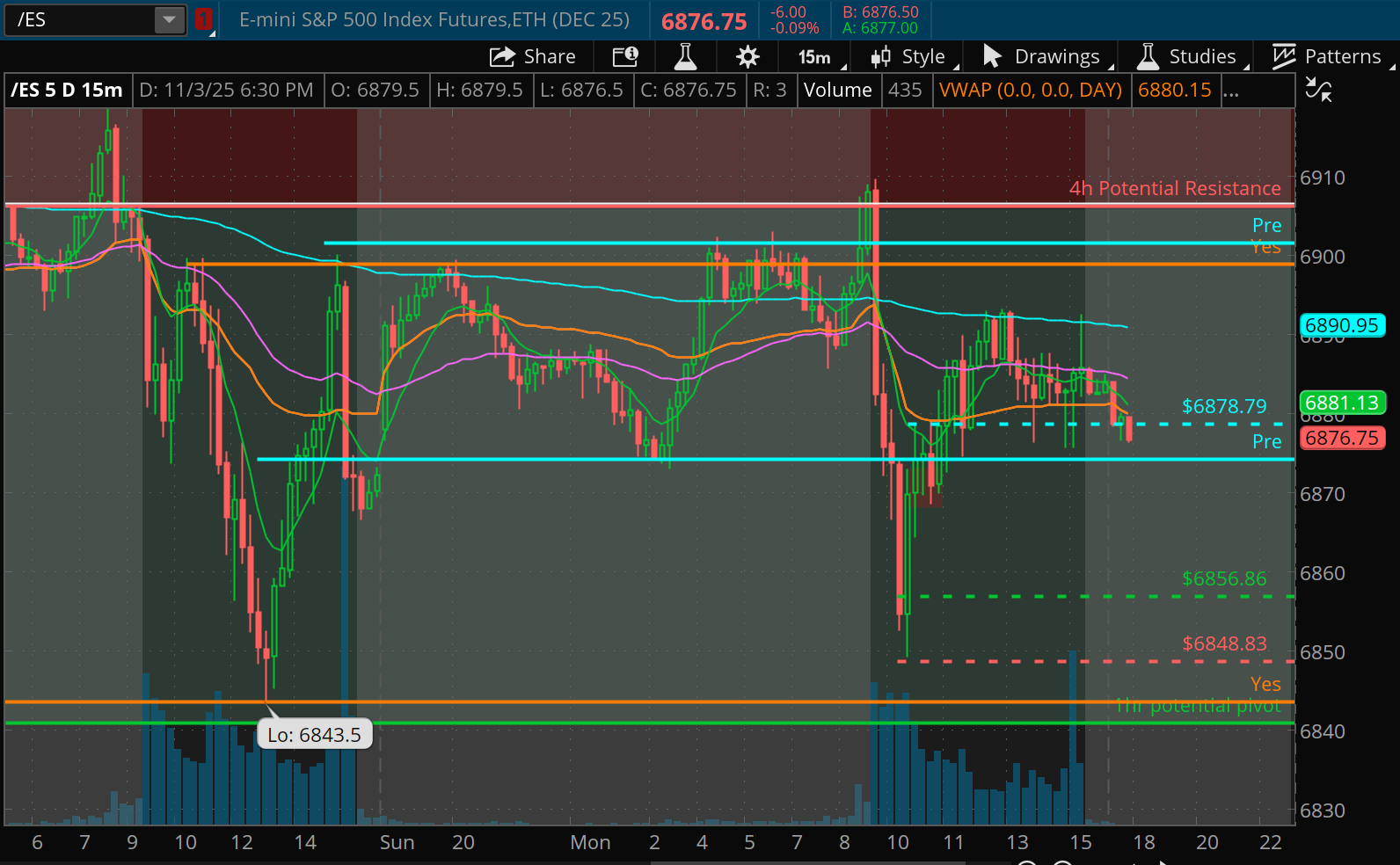

Well, I did have a really good entry price on ES. I anticipated the price action really well, but with the low volume and back and forth action, my premiums weren’t really printing money. I sold too early, worried that time decay will kill my premiums. But when i sold, that’s when it pumped up a little bit more until my options completely died. It could have been a $300 trade.

VIX started the morning around 17, which gave me a thought that there will be a strong downside action upon the open. It proved to be correct. So, for the first (I guess) Thirty minutes to the first hour of the market, ES and NQ were weak. I was waiting for ES to react on last friday’s low, which was around 6843. From there, I saw that there was a push up and I started buying from that level. As you can see below, I entered on the 6856 area, with a stop loss at 6848, a sniper entry that I am proud of.