A Chef’s Retirement Plan

Joe aspires to become a great chef.

At the age of seventeen, he’s been thinking about how there’s more to life than working late night shifts at Taco Bell, making fifteen dollars an hour. So he decides to go to school for about two to four years, earning him either a diploma or a bachelor’s degree that he believes will give him an edge to start his career.

School taught him all the essentials that he needed to know: how to cut, how to butcher, how to cook, how to cost things, how to manage people and expenditures, and of course, how to profit. After passing with flying colors, Joe starts his journey.

The degree proved to be useful.

For the next ten years, at the age of thirty-one, Joe rose from a commis cook to become a great chef de cuisine. He has mastered his craft and is ready to take on the lead, only to be surprised by the owners of the restaurant that he is now the new executive chef.

The next twenty years will pass and Joe, at the age of fifty-one, will have have done everything—from operating multi-outlet locations, managing a hundred-million-dollar-a-year restaurant group and mentoring the next generation of successors.

“I’ve got about ten more years in me,” he whispers under his breath, stating that his body has been experiencing things that are becoming unbearable as he gets older.

The next ten years passed and Joe’s health declined. Despite becoming the SVP of culinary operations, he caught himself in a dilemma of wanting to retire but couldn’t afford to. Having only twenty-thousand dollars in the bank—after amassing multiple raises and massive bonuses, he wondered where did all the money go while staring at the fancy furniture that had been custom-made by an Italian artist. Then he took a glimpse of the garage from the living room, through the glass wall that made everything sparkle more than they should, but the Porsche and Lambo have been quite a burden to him. Soon he realized how little of value and satisfaction these things have given him.

A faint memory of his friend, Bryan, is starting to recall in his head who, thirty years ago, mentioned about the power and magic of compound interest. Sulking on one corner of his leather couch, why is he thinking that he should have done something about that advice? Now the memory ripples in his mind, becoming more and more vivid as he stares at a blank wall.

___________

The Reality

While some chefs become business owners, leading to a successful restaurant empire and end up being as one of the faces of The Food Network channel, most of us live the common reality of trying to climb up the corporate ladder. The path towards reaching for the top gets narrow and challenging as there are not too many positions open for ageing chefs. If we can only set up automatic promotions for chefs ages forty and up to become culinary directors that make at least two-hundred fifty thousand dollars, then we should all be living a good life right now. But no, that’s not the reality that we live in. I know that you’ve seen sixty year-old sous chefs or line cooks and to me, these are not to be tolerated, except if they really love the action. I’m not patronizing these overworked chefs, for there are a lot of reasons why we are where we are now. Hard work, persistence and luck play important roles to our success. Merely showing up to work and doing mediocre performance are not enough to be ahead in life, read my article “The Importance of Going The Extra Mile.”

Solely relying on salary and bonuses don’t guarantee a bright future. From the words of the wise, “It is not how much you make that matters, but what remains.” You’ve heard Hollywood celebs, pro athletes and musicians who, out of nowhere, declare bankruptcy or beg for money. Allen Iverson can’t even afford a cheeseburger when he retired from the NBA. It is during your abundant years is when you must guard your wealth and load up to prepare for the “drought.”

When I went to school, they didn’t fall short in teaching us all the things that we need to know on our way in and while you’re in it. The issue is… nobody taught us anything about how to get out. The exit plan is the missing component of every school’s curriculum. Do you even realize that you are already too late in the game thinking about the exit plan ten years before you retire? The exit plan must start the moment you get in to the game. Yes, that’s right. The power and the concept of time gives you the advantage to have a successful exit strategy.

So today, I want to enlighten my fellow culinarians regarding how to set yourself up for a bright retirement. Let’s be real, even if we wanted to, at some point we will slow down and be in the way of the twenty-year old line cook that we work with. We will be grumpy and defend ourselves from small mistakes that we commit and say, “I’ve been doing this for more than forty-five years, you can’t tell me anything new.”

Rather than just be the problem, I propose that while time is still on your side, allow me to lend what I know in finance, and mentor you on how to invest and build a retirement nest that you can tap into when that glorious day comes.

My definition of retirement is to catch up with whatever time you’ve lost while you were in the labor force, without worrying about your financials while enjoying—that is to say, chilling by the beach and sipping a nice cold beer. It can also be just making it up to your children, taking them on vacation overseas or bringing the grandchildren to Disneyland. Before we can do these things, we must first plan to have the bare minimum to “survive” comfortably—this is where the numbers come in.

Be aware that this takes commitment and dedication. It may strip you off of all the glitz and glamour. Your friends might even leave you for being different. The results will not kick in (or may not) until after the tenth year of the investment plan. Although, if you trust in the process, you’ll be thanking yourself once you hit your golden age.

____________

The Plan that will change your life… in time

This is going to be an intensive article, so please feel free to read this in parts.

For those who are just starting your careers and those of you who have been in the game for ten years or less, listen closely. There’s no “correct” time to get started. You just need to start doing it, right now. And for those who have at least twenty years left before your planned retirement, it’s not too late for you. Honestly, in contrary to what I mentioned earlier, even if you have just about ten years left, we can still make it happen, you would just have to put more (financial) effort in. It’s better to have something rather than none at all.

To create this plan, we must follow certain rules. These are non-negotiable as each entry is essential to our path to financial contentment, or even freedom.

1) Find a career that you truly love and aim to be really good at it

2) Find a spouse who is understanding and will help you with financials.

3) Live within your means and save at least 10% of your wages

4) Invest—in any form you like and be educated

5) Continue investing, regardless of situation

6) Financial planning for retirement

7) Stay debt-free or minimize it

Let’s begin.

____________

#1 Find Something That You Truly Love To Do and Be Good in Doing It

What is that something that you will continue doing even if nobody pays you to do it?

You’ve heard of this question time and time again and yet, most people can’t answer it. Seems so simple on the surface, and for those privileged individuals who are blessed to live in a wonderful country and have plenty of options, this question is a no-brainer. But for those who were born limited and restricted to see strife and suffering on a daily basis, you’re just desperate to get out of your situation and would take any option available. Think about it, it may take time, but don’t take forever to decide, regardless of your situation. As long as you hear "rags-to-riches” story popping up, then there’s no reason for you to say that it’s impossible.

Lucky for us who are reading this, I guess we already know what the answer is. Aren’t we all chefs or aspiring to be one? Regardless of our situation, we love to give service to other people. If you’re using culinary as a platform for the next step, then you’re not too different to us—service is your love language, and that’s a very powerful and sincere form of career that people admire.

You may be wondering why this is my first entry to the plan, “Stanley, this has nothing to do with my financial planning.” I beg to differ. Choosing your career affects the outcome of your fulfillment in life, your purpose, your contentment and the longevity of your happiness. If you love what you’re doing, then chances are that you will stick to it longer despite ageing. You will enjoy your purpose in life and will help your community longer and more effectively. Comparing to somebody who hates his job, let’s say, a lawyer, who doesn’t really come to work inspired and ready to contribute in a positive way, they come to work because they have to. Participating in a career that affects your moral compass (of defending guilty criminals and extorting money from anybody that you can point your finger at) doesn’t really make you sleep well at night even if there’s seven zeros in your paycheck. I’m not singling every lawyer out to be miserable high-earners. The gift of culinary is that we can create something small with very little effort or capital required but deliver tremendous effects or results. Our efforts are sincere and oozing with passion to fulfill one’s desire, and that is: To give joy to people who surround us, in return, they bless us with validation that we are making a difference in a world of insincerity.

With the right strategy, timing and attitude towards our career, we can land promotions and raises. This will boost income and increase our saving and investing power. Imagine if you found out that you are about to make $1,500 more per paycheck? Think about that lump sum going to buying investments.

#2 Find The Right Spouse

Let’s be real… we are overworked employees. Averaging at least 50 hours a week is no joke. What happens to you after an 80-hour work week only to come home everyday to a spouse that just nags and complains about how absent you are in the house and more involved at work? Bring me a bottle of beer. Planning your retirement involves finding a spouse that understands what you’re going through and who’s in it for the long haul. If they understand, then they know that you will choose the restaurant more than them, most of the time, when you’re starting your career. Once you get settled and climb up, your family reaps the reward.

The right spouse also understands that culinary employees are not the best paid workers. As a matter of fact, we’re are under the payscale if you compare our wages to the grand scheme of things and the amount of hours we put in. If your spouse is supportive, then they will help you with house bills, making sure if one sinks, then everyone sinks. But when one rises, then everyone rises. Kudos to those who found a spouse who is willing to share half of the rent, the groceries and other necessities I’m not limiting to this set up as the one that only works, there can be different combinations. At the end of the day, when it works for both of you, then you shouldn’t change it. When a couple is helping each other out, then they rise from poverty faster. If it’s only a one-sided relationship where one leeches the other, then good luck. It better be worth it.

It is also scientifically proven that the most successful people are the ones who found the right spouse and built a family around them. A fruitful relationship with a solid foundation helps chefs like us strive harder even more, not because of necessity, but because we know that somebody understands and supports.

#3 Live Within Your Means & Save Ten Percent of Your Wages

At this point in your life, you don’t really have to be educated with any form of investment, yet. You just need to save. If you can save at least ten percent of your wages, then you’re already ahead of the ninety percent of people. If you can save even more, then you are going to live abundantly. The key is to consistently save, regardless of whatever happens in your life. Put away a part of your earnings to safe keeping. If you want an in-depth guide on how to become rich, read my review of the best financial book that you can ever read, The Richest Man in Babylon.

Let’s create an example.

Figures are all hypothetical.

First thing’s first, is that I determine my monthly take home pay. Say that I make $80,000 a year, then my take home pay here in Miami will be around $1,300++ per week, $5,200 a month. When I apply for a new job, I always max out the most of what I can take home per paycheck as compared to having automatic additional deductions going to the government. To me, I like to worry about the tax filing later and make the most of the opportunity cost of my money in my pocket. Make no mistake, the 10% withholding tax is still being taken away from my paycheck, I am talking about additional deductions. The way I see it is that if I give the government more money upfront, then that extra $100-150 is gone and I won’t see it until I file our taxes. What I do with that extra money is that I start paying myself first, in the form of utilizing it as my contribution for my IRA account (more on this later) or I use the money to fund my stock brokerage account where I can potentially generate more income.

Rent must be less than 30% of your overall pay. This is where a spouse comes in to play who helps with bills. If both of you are working and make at least $140,000, then an apartment or a mortgage of up to $3,500 per month is attainable. Anything more than this is causing you to save less.

Groceries is a tricky game. As chefs, we are known for eating junk all the time, because that’s what’s convenient and fast. I have already vowed to never downplay my home cooking ingredients, and so when I’m at home, I always make sure that we are well fed. It’s all up to the person who is budgeting. Groceries can be 5-15% of your take home pay, a month, considering combined income or not.

10-15% of my paycheck normally goes directly to my savings account. Our current living conditions allow me to do so. But since I already have enough emergency funds put away, I just keep on adding money to my retirement and regular brokerage account on a weekly basis. I don’t allow to let a month go by without investing or saving, that’s the bottom line. There needs to always be some type of process where you retain money, not just spend it all. There’s plenty of people living paycheck to paycheck because of their impulsive nature to spend. If you have this type of attitude, then you’re always at war with yourself, recognizing which are essentials from impulsive expenditures.

I’ve meet people who are younger and earn less than me drive a porsche and other flashy cars that they can’t afford for the sake of looking cool and boogie. I’ve worked with an individual who decided that he was going to buy a Mercedes out of the blue. His plan was to walk in to the dealership, give his price and walk-out when they don’t agree to it.

“Why are you buying a car that you can’t afford?”

“I’ve always wanted one ever since I was young.”

“I know, but where are you going to get the payments from?”

That was the end of the conversation, and in the end, he didn’t get the car as he probably gave a low ball price that made the car dealers laugh.

Rent, electricity, groceries, insurance(s) and commute expenditures are what I consider essentials. Work your budgeting around these and consider them as fixed essentials.

By the time you reach the budgeting stage with your wants, then you should already have paid yourself. Vacations, eating out, booze and lavish clothing are what I consider as noise, these expenditures are highly discretionary and must be controlled.

The only way you can save is by living within or under your means. When you are young, your body tends to be VERY, VERY forgiving. You can eat the nasties food for at least five to ten years years from the age of eighteen and it won’t really do much to your body. If you can save money by eating instant ramen six times a week, then do so. Crunch down the numbers of your expenses and put all of those towards your savings. If you’re already working at this age, then you’re on the right track. You can work as much as you want without taking a toll on your body.

Don’t cave in to the pressure of having babies from your ageing parents. Times have changed and it is no longer easy to just bear children. The 50’s all the way to the 80’s were some magnificent decades for having children because you just had to work hard (and you don’t even need to be good at it) to support a child. Now that competition is intense and prices have drastically gone up, being a hard worker is not even enough. Let alone having two jobs. In reality today, you need to be skillful, resourceful and unique. America promotes individuality, you always must outshine other people to earn. My advice is until you get north of $80,000 in your savings, keep Richard away from anything that you may or may not regret later. Be a responsible adult and only give life when you’re ready to support it.

Take advantage of working doubles and getting overtime pay. Although, I always believed that it’s better to do one job really well rather than to be mediocre at two or three. Promotions are sort of a “retirement plan” the way I perceive it. The more you climb up the ladder, the more you can utilize other people’s time to your cause of progressing. You can leverage the “freed up” time doing more meaningful work for yourself that can improve your current situations. I see a lot chefs nowadays fall in love with having two jobs that pay them $25-27 upfront. Yes, they make a lot of money, but how long can they do that for? Rather than sacrificing and learning the skills needed for management, and taking a blow for making $55,000 to 65,000 working 60 or 70 hours for a couple of years, hourly cooks would rather "save” themselves from this situation, impeding any potential growth.

Save, don’t gamble, refrain from spending on foolish things like drugs and fancy materials that don’t bring in more wealth. These vices eat up your savings and ruin your mental health.

More importantly, find ways on how to earn more. It is easier to earn an extra $5000 a month than to save $5000 a month. As a chef, you can never be content of what you know. You always need to evolve and become better until you get to the top of the food chain. You may not be the best cook, but you can be the best at communicating with people, or organizing millions of moving parts for a 15,000 pax event. The amazing thing about being a chef is that there are various specializations and There’s a position dedicated for them. Find your niche whether it is in banquets, retail pastry, restaurants, country clubs or private cheffing, the sky’s the limit for you to shine and spread your wings. But the bottomline is that you must earn more almost every year.

#4 Learn How To Invest and Continue To Be Educated

Youtube and other sources of information regarding investing have blown up. You can sit down and watch a video that walks you through whatever investment you can imagine. Having a mentor is also essential in having a fruitful life. Learn, learn and learn. Invest time in yourself to learn the many ways that you can turn your money into more money that makes more money for you.

First thing’s first, is to keep money in your savings account that reflects about three to six months of emergency bills. This should cover your rent, utilities, groceries, car payments and other necessities. Whatever comes after that emergency amount, is what you will put in your investment(s).

There are many forms of investing and I am not well-versed in every one of them. But what I do know, I’m good at. You can invest in flipping houses, collecting Pokemon cards, NBA cards, watches and etc. These investment ventures are for you to discover. As for me, I invest in precious metals such as silver, I also have stakes in Real Estate Investment Trusts that provide me with monthly dividends, long term holding of equities and etfs, and Options trading.

I can mentor you with these said investments as I know them very well, except for short-term options trading. Trading is risky and only 1% survive. I don’t suggest doing it for an ordinary chef that doesn’t have the time to sit down and look at charts the whole day.

#5 Invest, no matter what happens, if permitting

Life is a roller coaster and you’re not always going to be on top. There will be times when you can loosen a little and reward yourself, and there will be times when you need to tighten up the belt and breathe in really deep. One thing is for certain, never, ever allow yourself to lose your job or your source of income. No matter what that is, you always need to have a job that helps you generate income. Chances are that even if bad times come, as long as you have your job and you’re good at it, you will eventually come out just fine. At the same time, never stop saving and investing during the good and bad days. This discipline just strengthens your conviction to become financially free. Consider putting away money for your investments as a regular bill or expenditure.

#6 Financial Planning For Retirement

You must have a plan on how you’re going to exit. It’s not like you’re just going to decide that you will stop showing up to work and cash out. Retirement planning takes time and a good strategy to ensure that you’re going to stay afloat once you let go of your main source of income (for common employees). If you need help with your retirement plan, there are a multitude of financial advisers who can help you set it up. There’s no better way to retire knowing that you have plenty of options on how you want to go about it. Once you have a decent amount of money put away, then it is your responsibility to make sure that that value will last you throughout your retirement.

On the surface, this is basically the most simple retirement plan that you can think of. If you follow these steps, then you should be ready to face the unknown, while you’re at a beach, sitting under the sun, sipping your favorite choice of beverage.

#6 Stay out of debt

This is the number one killer of financial freedom. I want to be clear that paying for a mortgage and a decent, humble car are what I call good forms of debt. These are investments, that make your life convenient, is for your sanity and time. A humble and a reliable car that will last you at least ten years is all you need to take you from point a to point b. A decent house that protects your head from calamities and allows you to sleep soundly at night is a necessity to come to work prepared and rejuvenated. But owing money because you bought jewelry, a fancy sports car, shoes or etc., are wealth breakers and will hinder you from being successful. Trust me, I’ve been there. I’ve loaned thousands of dollars from the banks to fund my day trading account and I blew them up in a matter of days. The emotional damage that it leaves scars you for years and years, on top of that, there’s a pressure to pay for the loan.

Don’t think too drastic… don’t take loans with payment programs that you can’t afford to pay for in lump sum, those $75 programs for seven or eight years add up and the next thing you know is that you’re already tied up again to another loan.

______________________________

Types of Investments You Can Venture Into

Now that you have the blueprint of how to retire, then let me know you where to invest your money. This is based off of being a regular cook, chef or whatever culinary positions you entail. Yes, you can always add another source of income like flipping homes or landscaping, but then, that is another active form of income, that also doesn’t guarantee anything. What guarantees your future is how much you save, not how much you make.

For people who are not educated in investing, they see it as a restriction for them to enjoy what they have. They want their wealth readily available to them whenever they need it. Yes, there is an associated feeling of accomplishment to see your money sitting in your savings grow, but then, inflation eats the value of your wealth. Putting your money in investments will always have an associated risk that comes with it. Although, the good thing about this is that you can control how much risk you can tolerate. By risking, you allow your money to grow and beat inflation.

Don’t forget, even the best investors will always tell you that you need to enjoy the fruits if your labor, as long as it is in moderation. As wise investors, we reward ourselves when we achieve a milestone, keeping the thrill of rewarding yourself a privilege, hence inspires you to grind harder. If you allow yourself to often feel that emotion or euphoria when you buy something, then it loses its purpose, it fades quicker. The next thing you know is that you don’t even feel anything anymore when you reward yourself. Avoid this. We are seeking longevity in satisfaction, not everyday instant gratification.

Let’s begin.

Investing in the Stock Market /Cryptocurrency (In the US)

This is by the easiest and most popular form of investing. The market has provided so much wealth to those who know how to utilize it.

With the advent of accessible investing platforms, it only takes minutes to choose a one and create an account. Platforms such as Robinhood (for a more mobile approach), Schwab, Interactive Brokers or ThinkorSwim for advance investors and speculators, are available to even the most regular line cooks. There are guides on how to open an account on Youtube. Most, if not all, banks have their own form of investment accounts where you can purchase and sell securities under their platform(s). The next thing to do is to transfer your hard-earned money to your account(s). Transfering money is simple, like collecting money from your Venmo or Paypal account back to your bank.

Now before you go crazy and start buying stocks, I suggest you set up two accounts that will serve two different purposes. These will dictate your present and future, and must be set up as soon as you start your career, or while reading this.

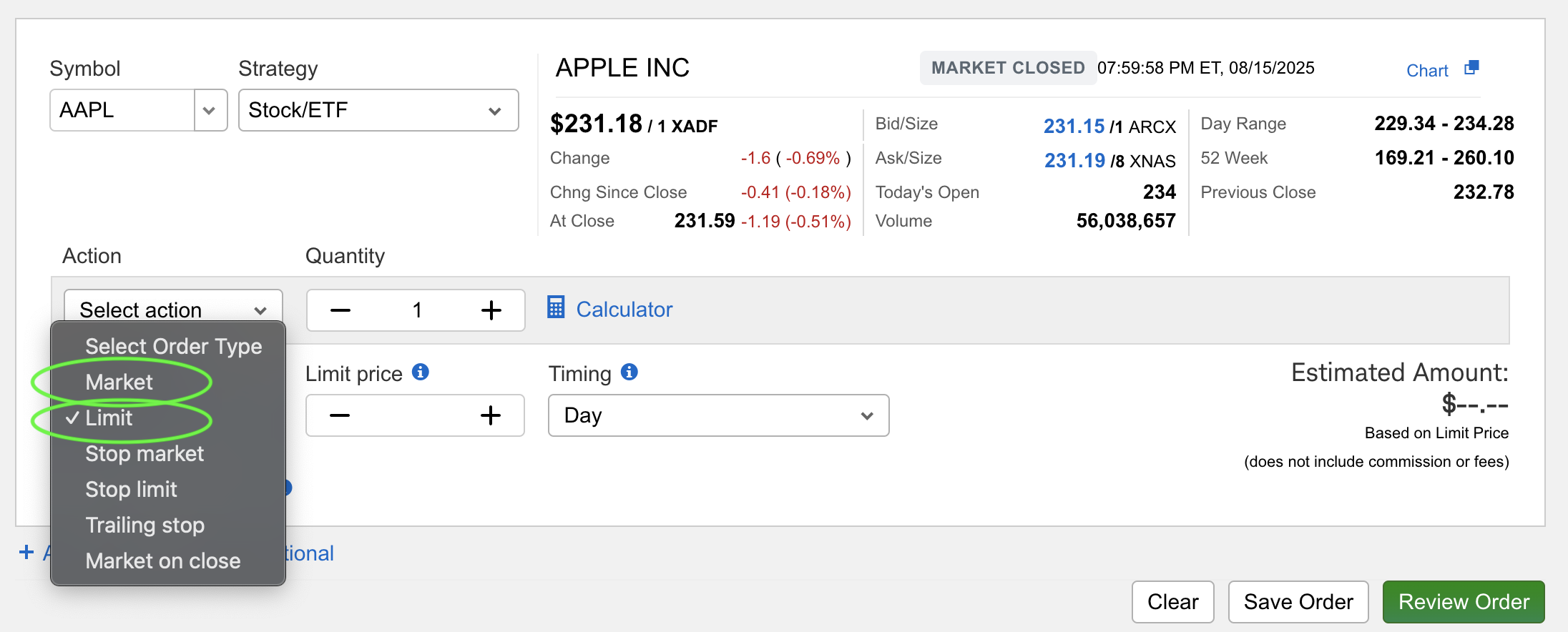

Here are some photos of how to do it. I’m using Charles Schwab for my brokerage. There are different platforms but they all require the same credentials.

First is to click the Open an Account Tab.

Decide which type of account you want to open (I’ll explain these later).

Fill the form out with your credentials. You must provide proof of your legality to live here in the US. Go through the process and you should have an account within 1-3 days.

Once you have an account, you will be led to your dashboard or summary. Now, In order to transfer money from your bank, click Move Money. Under the Money Money tab, click Transfers and Payments or Online Transfers.

You can choose how you would like to transfer your money. I always prefer direct bank transfers. It’s convenient and fast.

Use cash only and connect your bank account.

Type in the desired amount of money that you wish to deposit.

Schwab will prompt you to review your transaction before comfirming.

And once you’re sure, then hit submit and it will give you a confirmation. Funds may need 4-5 days to settle, depending on the amount that you deposited. You can instantly buy and sell assets upon depositing money.

Open a regular, individual brokerage account- This account will allow you to pull out any gains or profits that you make for you to enjoy, anytime. There’s no limit on how much you can deposit (we’ll compare this later). Let’s say that you put in your money today and bought a share of Apple for $200. Tomorrow, Apple opened at $250, thanks to a breakthrough in AI technology. If you decide to sell it, you can pull out that $50 profit that very day, transfer it back to your personal bank account and enjoy it in anyway you desire.

I call my individual brokerage account as “Enjoy Money.” This account is for me to enjoy from the quick gains that I generate, as I do high frequency day trading. Whatever gains I generate from this account, I use it towards my wants, such as paying for a lovely dinner with my wife, buying myself a new guitar (which I recently did, don’t tell the wife). On top of this Enjoy Money account, I also have another joint account with my wife and that’s where we add money on a regular basis and buy quality stocks such as Google, Apple and etc. We are planning to grow that account for us to use whenever we want to go on vacation. We are not pulling out any money until we see it grow to a certain amount. These accounts, like I said, are available for you to withdraw from whenever you feel like doing so. The only downside about making profit out of any stock market or crypto investing is that they are taxed, depending on the amount of time you held a security or asset.

Open an Individual Retirement Account (IRA)-There are two types of IRA’s, Roth and Traditional. Both Accounts restrict you to about $7,000-$7,500 in yearly contributions, meaning, that you can’t put in more than that every year. I did the computation and it’s about $135-$140 a week in contribution. Aside from the similar contribution value, they are governed by the same law regarding the age allowed for you take money out. If I’m not mistaken, you can start pulling out money at the age of 59.5. Anything earlier than that will have penalties. Now, for as long as you don’t need that money pulled out of the account, you can let this money ride and earn. By the time you’re in your 70’s or 80’s, after 20-30 years in investing, then you’re sure in a good spot. You might not even need this anymore other than as a form of Christmas gift for those people who are extorting money from you. You know… abusive aunts, uncles and relatives who just sprouted like mushrooms. Don’t forget your friend who didn’t talk to you for 30 years and now considers you as one of his besties. hahaha.

Here is where these both accounts differ:

Traditional IRA taxes you for the gains that you’ve made within the year. But when you start pulling your money out once you retire, you have free, non-taxable, money. Yes, when you buy and sell apple in your traditional IRA, you get taxed for that. You’re paying your duty upfront and get whatever is left after, when you retire.

Roth IRA taxes you WHEN you start taking money from the account. Any gains you make are non taxable. Consider this as regular income. And with regular income, it depends on how much you take out. So If you pull out around $150,000 a year, then you are going to pay the corresponding taxes in that bracket.

Uncle Sam and His Capital Gains

Anything that you hold for more than a year gets about 12% capital gains tax. This is called Long-Term Capital Gains

While anything that you hold less than a year gets about 18-20% capital gains tax. This is called Short-Term Capital Gains

With our profit of $50 from Apple, we get taxed $10, at 20%, since we only held it overnight. If we were to hold it for ten to twenty years when apple is now at $500, then our $300 profit will get taxed only at 12%, which is about $36. Consider your gains to be added to your overall personal income for the year. For example, If you are making $75,000 as a sous chef, then the profit from apple of $36 will be added to your total taxable income of $75,036. The more you make, the more you climb higher the tax bracket.

In addition, I want to clarify that as long as you don’t sell, you won’t get taxed. That’s why I suggest keeping the security as long as you can. If you keep on buying consistently, depending on your plan, which can be monthly, weekly, quarterly or even daily, then at the end of the cycle, you will lower your average cost and make the most out of your gains. This is what we call “Dollar Cost Averaging.”

Some Chart Computations to Convince You to Invest

I want to show you a computation that I made for my Roth IRA account, to prove that I practice what I preach. Unfortunately, I started late in opening an IRA, at the age of 32, being foolish with money during my 20’s. Having lost tens of thousands because of day trading, it set me back for at least five to ten years of being financially ahead of my age group.

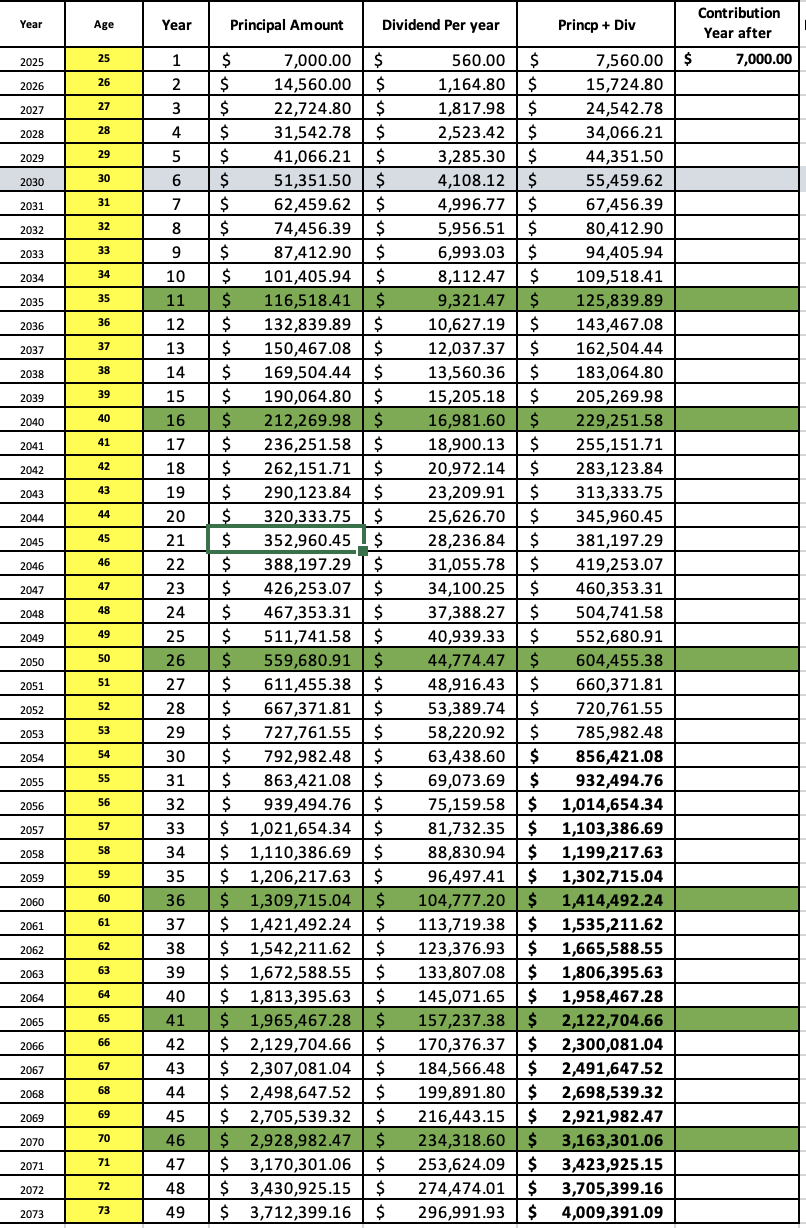

During my first year, I messed up by day-trading the account and lost the entire contribution amount of $7,000. I started again and I’ve been in it for two years—not touching anything, but just continuously adding more and more. Below, you will see the capital, how much it makes in dividends a year and how much it will yield by the time I’m 82. I highlighted some milestone ages like 60, 65, 70 and etc. The chart below shows the power of compounding at a humble rate of 10% a year.

If you notice this chart, the fun doesn’t start until you’ve past your tenth year. After the tenth year of over $100,000, that’s when you amplify your gains. By the time that I’m at the ripe age of 60, when I’m grumpy and hate everyone around me, I would already be making about $100,000 a year. But I guarantee that I won’t be needing this money when I’m old. I’ll probably start pulling money out at the age of well… I don’t know. Never? this is going to be generational money for my kids, grandkids and great grandkids. According to Joshua Sheats of Radical Personal Finance, I found out that you can keep the money growing up to ten years after your death until the beneficiaries must start taking money out of the account. If I die at the age of 70 (year 2061), then by the year of 2071, my family can pull out around $700,000 a year in earnings. Not bad. Well, let’s hope that the dollar retains its value of being the top currency.

Don’t forget, inflation is about 2-3% annually, and with a return of 10-14% a year (on a good year, 6-8% for a more conservative return), then your money is surely winning against inflation.

For those of you who are wondering whether you can do this in a regular personal brokerage account, yes you can. If you are happy with the tenth year income, you can start pulling that income out of the account any time you want. The good thing about having a personal brokerage account is that you can invest as much as you like, without any limit. If you won the lottery today and took home $1M, put it in the stock market, I guarantee that with proper investing, it can generate at least 6% a year. That 6% across ten years will set you up for life, including the capital.

Here are other chart computations for somebody who started at the age of 18, 25, 40 and 50, being consistent with the contributions and making about 8% in returns, which is very reasonable. As before, I highlighted some milestone ages and the first ten years of investment. Let’s check them out.

If you look at the chart above, you will notice that a kid who started investing at the age of 18, will become a millionaire by the age of 50 on his retirement account, having only invested about $231,000. That’s 400% in profits that I’m sure he won’t touch until he becomes 60.

If you started investing at the age of 40, then looking at a horizon of 25 years will give you a better return towards your investment. At the age of 65, $500,000 doesn’t seem that bad. Although, if you are still strong and capable of working, then retiring at 70 will give you a better nest to lay on. That golden age of 72 are just two years away, but it adds substantially to what you can retire with.

Retiring at the age of 50 is still doable, but like the person who retired at 40, you might have to stay in the labor force quite longer. If you’re capable of doing work and are enjoying what you do, then a horizon of 30 years will set you up just fine.

I am deeply disappointed that school doesn’t teach us about this. If everyone knew about the magic of compound interest and choose to actually invest, then nobody will end up being unfortunate. But like I said, I get to say this because I live in America, where the stock market is liquid and favored by the entire world. What about people who live in different parts of the world? I come from the Philippines and our stock market is not as amazing and liquid as America’s. But then, I still have a small investment that generates dividends. If I had put in more money, then my investment could be pretty substantial now. And as a reminder, it is not only the stock market where you can invest your money in and create significant returns. In the world today, you can make money out of thin air. Youtubers are making more than doctors or even actors now. Hermes bags beat the S&P500 by astronomical numbers, paintings, wines and other novelties are now becoming sound investments. Buying and selling of watches pay even better than doctors.

Please be reminded that these are very conservative numbers. The current return of the market is about 10% as a whole, while some sectors excel more than the overall market, such as REITs.

Purchasing Securities & Other Securities & Things That You Need to Know

Ticker Symbols

Ticker Symbols are the names of companies in the stock market. Apple for example is AAPL. You can google your most favorite companies and check out what their ticker symbol is, as long as they are publicly traded.

Once you determine the company that you are ready to invest in, then type the symbol. Information regarding its charts, financials and other news regarding the said company will show up.

Types of Purchases & Orders

In the stock market, there are many ways on how to purchase a security. But the most important concept (to simplify your investment journey) is Buy and Sell. Sell Short and Buy to Cover are for more advanced investment and speculation. See highlights below. Buy low sell high is the golden rule in investing.

Bid And Ask

When purchasing securities, there is a bid and ask spread. BID is plainly the price that buyers are willing to pay. ASK is how much people are willing to sell. Any gap in prices in between is what you call a spread, and this is how market makers (mediators of the stock market) make money. Think Ticketmaster selling Taylor Swift Tickets. Taylor Swift wants her tickets to be sold at $100. You, as a buyer/ consumer is saying that you’re willing to pay $95. Ticketmaster, representing TS is making money out of the $5 gap between $95 to $100.

Market Orders

Some people, who are die-hard fans, will say that they don’t care how much the tickets cost and are more than willing to buy what the “Market Price” is. If you purchase using Market Order, you will automatically be assigned the shares depending on what the available supply is.

The Pros: instant fill, you can get it a trade right away and take advantage of any sudden upside movement.

The Cons: being impatient can mean that you are getting filled with prices that are a bit higher than the selling price. This is no guarantee, it depends on price action.

Limit Orders

Limit orders are the fans who want to buy tickets at a discount. In order for them to get the best deal, they will wait for the ticket to come to their desired price at $85. Therefore, the order will not trigger until Ticketmaster caves in and sells her tickets at a discount, just to fill the stadium.

The Pros: You buy stocks at a discount or a fair price, depending on your perception of what is fair. This also allows you to become disciplined in knowing when to enter properly.

The Cons: Your limit order may take a while to trigger, hence missing out on current price action that may or may not really visit your price mark. Lost opportunity is the cost of being patient.

Stop Market, Stop Limit, Trailing Stops are for more advanced investors.

Fundamental Investing and Technical Investing

There are two types of investors.

One person reads company reports, P & Ls, 10Ks, and analyze the value of a company and its products or services. They believe that companies that have good numbers, that bring value to the community, will prosper in the long run, hence buying stocks of the company while it’s still undervalued. So, the fundamentalists will hold these stocks for a long period of time and sell them once they see any cracks with the future of the company or when they become overvalued. Think Warren Buffett.

Technical investing is when you don’t worry about the company’s health. You only look at the company’s stock chart. They buy or sell when the stock reaches a major price point, and re-enter when they see that the price is balanced or in good value.

In my case, I am both a fundamentalist and a technician. I buy and hold good stocks like Google, Apple and Microsoft, knowing that they are huge companies that are constantly creating something new to better the lives of people. They have become household names that it’s a bit difficult to think that they can fail. Of course, nothing is guaranteed. I can even call them “too big to fail” companies. These companies get special treatment from the government because if they fall, then they bring with them the entire economy down. This topic is more advanced and can be tackled in the future.

Most of my days are spent watching the charts, buying and selling within hours and even minutes. This is risky for it requires a lot of learning and failing. It’s not for the faint of heart, especially when you’re so desperate to make a quick buck. The first time I made $2,300 in 15 minutes at home, in my pajamas, without having to brush my teeth, I told myself, “why do I even have to go to work!?”

I’ve made $12,000 in a day, but I’ve also lost $27,000 in a day. If you can forgive yourself and ride that mental roller coaster, then you might be able to make it. Only 10% of day-traders make money and 1% make it really big, 90% lose and give up. In my heart, I know I am already a profitable one, I just need more time and practice to master it. I can’t explain to you how much stress this profession has given me. It took at least 12 years of my life hating myself for it. But now, I don’t see any other career (except for culinary) to be the best one out there. No meetings, no bosses, no employees and no lawsuits. You just sit down on your computer everyday, click some buttons and you make money depending on your target. You can make as little as $1 a day or $1,000,000++. The best part? You can even do it naked, at the comfort of your own home.

Let’s skip the drama and let me show you how to read basic charts. It is highly important as both fundamentalist and technician to be knowledgeable in reading charts. If you know how to read charts, then it can give you insight on having the best prices to buy or sell. It doesn’t take that much, you just need some screen time and practice.

Let’s begin.

HOW TO READ CANDLESTICKS

There are different types of charts that you can analyze, lines, waves and candlesticks. Candlesticks are by far the most technical in detail for it tells you a story that no other chart can show.

When you look at a chart, think of it as a story. Candles form to tell a narrative, called price action. A candle can either go up or down, but what’s important is the length and the shape of how it closed. Each candle represents a timeframe, and it all depends on how you set it up. You can set one candle to be a month, a week, a day, an hour, a minute or even ten seconds.

When candles form, the system keeps track of the position that it opened. From the opening, the stock will move and create a body. The body will then expose if it’s a green candle (a positive one) or a red candle (a negative one).

Green candles dictate that the stock wants to go up. Red means that it’s trying to go down. But don’t get fooled as there is so much more to the colors. The context varies depending on market sentiment, overall trend, price action and manipulation and support and resistance levels (more on this later).

Candles that have more meaning or weights significantly are called the high timeframe candles, these are your monthly, daily, weekly and 4-hour. This is where you mostly see the major trend of the stock market and are more “respected,” we’ll tackle this later.

While the low timeframe candles are your 5-minute, 3-minute and 1-minute. These have more noise associated with them and are best for finding the right entry to buy or sell a stock because of how precise the movement is.

Let me show you how price forms starting with a low timeframe up to a high timeframe. Let’s pull up the chat of $SPX or the S&P500 Index

This is the 5-minute timeframe, where each candle represents 5 minutes of trading since August started.

Below, is the 1-hour timeframe. As you can see, the movement started to be cleaner and has less noise.

The 4-hour timeframe now looks even better.

This is the daily candle.

Finally, the monthly, where August in highlighted.

If we go back to the 5-minute chart and bought during the lowest point, then we were able to take advantage of the profits.

investors and traders alike observe high timeframe candles first and go down to low timeframes so they can enter at the best possible price.

__________

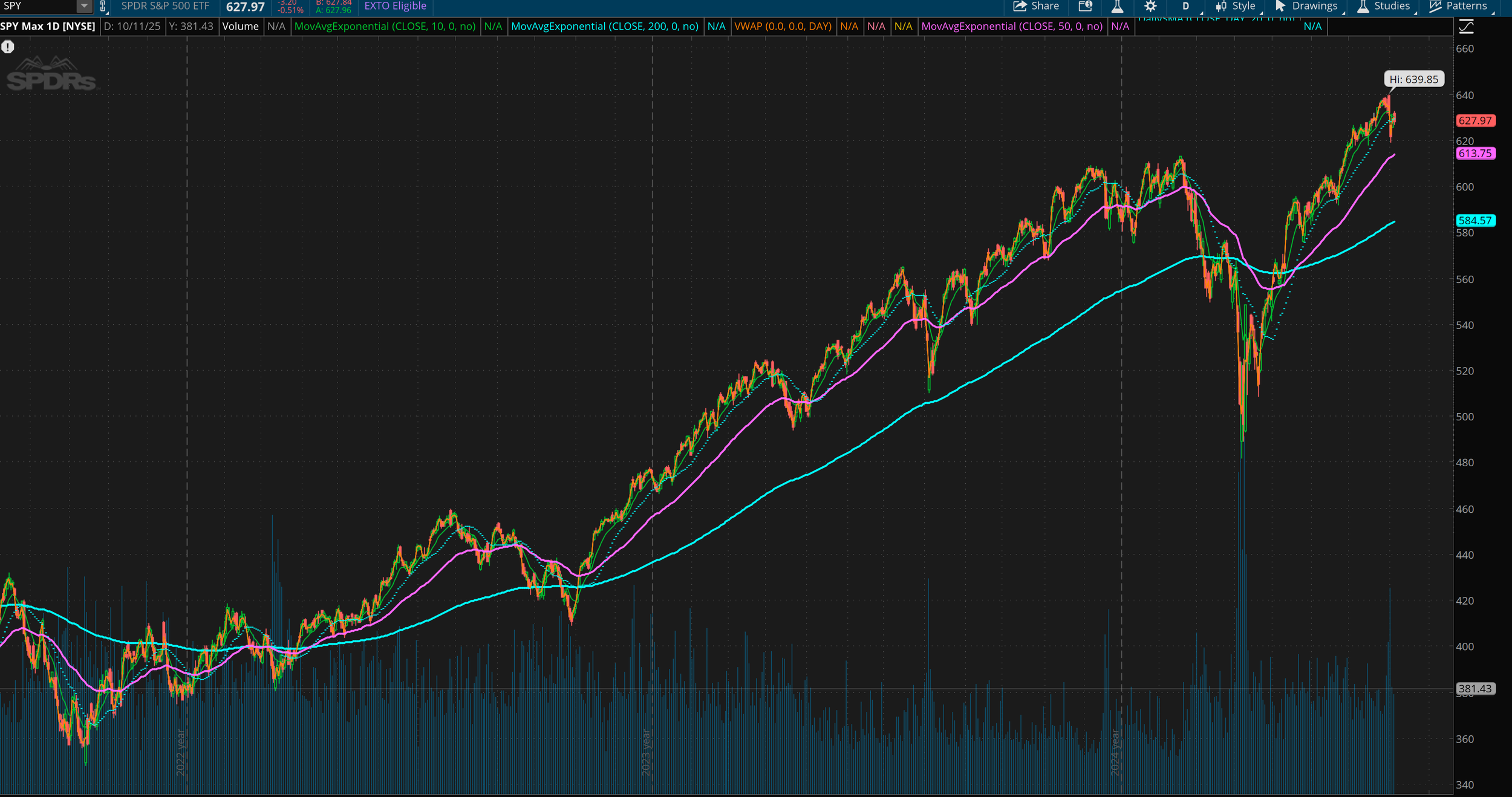

Let’s look at this chart of the $SPY or S&P500 ETF seen above. This is one of the leading stocks or ticker symbol of the market. Each candle represents one trading day and you clearly see the overall trend is going up, despite the recent pullback when Trump announced tariffs. As you can see, after the news broke out, there was a “V-shaped” recovery that occured in the market, which pushed the ETF to all time highs.

Now, for you, as a new investor, is to get in at the best possible price, while you dollar cost average. If you would have bought when the $SPY was at $480, then you could have made a lot of money within a short period of time. Your job is to be in-tune with the news. The news is the gateway for opportunities in the stock market. And please pay attention to this: You can make money when things go up (long) and you can also make money going down (short). Being “long” is when you buy a stock expecting it to go higher. “Shorting” is the act of borrowing stocks to “sell” against the company, expecting it to go lower. This may be a bit confusing but let me expound.

Let’s say that Apple is at $210 and there’s news about bad earnings for the current quarter. If I am expecting Apple to go down to $200, then I would “short” the company to the downside. By “borrowing” stocks from my broker, I can bet against Apple to head down to $200. And from this, you make money when stocks go down. The downside of shorting is that it requires a lot of capital, for collateral. And the possibility of losing your money is significantly higher because Apple can even go up even further with bad earnings report. What if you bet 1000 Apple stocks short from $210, expecting to go down to $200, but it reverses and goes up to $230? You just lost -$20,000.

Shorting the market is a risky but rewarding style of trading. You don’t need this though, not unless if you become an advanced technical investor. Although, I’m just basically stating that you can make money either way.

Let’s continue looking at different candle timeframes.

This is the chart of SPY when Tariff Liberation Day happened on a 15-minute timeframe. Each candle represents 15 minutes.

This is SPY during the same day, on a 1-minute timeframe.

Now, you don’t have to be super technical about this concept. You just need to learn a little so you can enter to buy at the best possible price. In reading charts, we have what we call Support and Resistance.

Support and Resistance

These two concepts are levels in the chart that dictate the future possible flow or movement of a stock. See photo below.

Notice the two green solid lines that are highlighted. If you notice, price tends to react whenever it reaches these points. These points are what we look for so we can “predict” or anticipate future price action.

Resistance is the ceiling of price action. Imagine a roof of a house. If you’re inside your living room and have a balloon that you wish to let go, it will only hit the ceiling and won’t go anywhere. That’s the same concept in reading charts, a resistance level is a price level that rejects any upward movement from moving any further.

Based from the example, the line that holds $480 had a good influence for price to go down.

Support, on the other hand, is the opposite of resistance. It is the baseline level of price action and acts as a “support” for price not to go any lower. If you notice, the highlighted price level of $354 is where SPY stopped and bounced the price back up.

Now that you have the basic idea in mind, as a long term trader, support will tell you when to buy (as long as it doesn’t break below) and resistance will tell you when to sell (but not in all cases).

There will be times when resistance will get broken and price will go even further up only to fall back to that same level and turn it into a brand new support level. Look at the $480 level. This signifies that the chart is on an uptrend and will continue going up. Buying at $480 is the best price that you could have bought it for before the wave to the upside started.

Start looking at different charts and plot out different points and see how price moves towards those levels. it takes practice, but once you become good at it, then it’ll reward you forever. Shall we look at more examples so that you can gain more experience? Perfect! I thought you wouldn’t ask!

Let’s go!

Just a reminder, when trying to determine future trends, always go for the higher timeframe, at least 4-hour or daily.

Here is a chart of the infamous United Health Group, Ticker Symbol $UNH. Let’s analyze the chart.

With all the rumors and fraud surrounding the company, especially when their CEO got shot by an individual, you can’t help but expect that the stock will at some point, go down. Lo and behold, after a few attempts of touching the support level, highlighted in red, when the news broke out, $UNH broke down and plunged. This an example of a potential dip buying opportunity where you can get in at cheaper prices and hope that the stock can go up or this can also mean that the stock might not be able to recover and go back to the $400’s.

$UNH plunged down after a few attempts touching the support with negative news

Let’s look at another chart, $AAPL when it attempted to touch resistance along the $198 level twice, before breaking it to the upside, re-touching 198 and turns it into support and headed to $260. Although, during liberation day, apple plunged from $260 down to $211, trying to hold it, but eventually went down to lower than $198, briefly, and then recovering to get back to the $200’s.

Finally, let’s tackle Amazon. When a stock is stuck between a range bounces off between these levels, this is what you call a sideways consolidation. This can mean that the market is in equilibrium and that the stock can’t decide where it wants to go. But then, you can see that Amazon broke the resistance and attempted to create a new support three times.

You’re getting better at analyzing charts. Keep it up.

Specifics on Where to Put Your Money in The Stock Market

Now this is the fun part. Ever heard of the term “don’t put all your eggs in one basket?” Well, in this section, we will tackle that.

When you create a portfolio, you have the freedom to invest in any sector of the market that you like. Sectors include: Technology, Health or Medicine, Banking, Consumer Discretionaries, Energy, Retail, Commodities, Precious Metals and many more.

You would also like to keep in mind that having a diversified portfolio protects you from any unforeseen financial calamities.

How to diversify?

Let’s begin by putting a value to our portfolio of $10,000. Now, say I decide to put $1000 in tech, because growth in tech is fast but risky. $2000 in banking to protect me, since banks are more stable and established, $1000 in health if there’s a new breakthrough in medicinal technology, at least i’m gonna profit from it, $3000 in real estate, because you can’t go wrong with real estate, it always goes up even if there’s a recession. I also want to get $2000 in ETF’s, such as the $SPY and $QQQ that are made up of different sections in the market and are managed by firms. These don’t fluctuate that much but they are amazing long term positions to hold forever. Lastly, I’d like to keep $1000 open, just in case something pops up out of the blue and can make me a quick buck! Pay attention to stock economic news to make the most out of your investments. News open opportunity for big moves that you can profit from.

Now that we have diversified our portfolio, learn how to track long term trends and see where we can buy, sell and re-enter. The style and percentage that you allocate for every sector depends on your investing style. You can go a bit aggressive by staking 50% in tech and the other 50% broken down to other sectors. You can do more finance-oriented by investing 70% in financials and 30% in real estate, sky is the limit.

TICKER SYMBOLS THAT WILL CHANGE YOUR LIFE. FOR REAL. FOREVER

ETF’s to Remember Until You Die

$SPY, $QQQ, $VOO and $VTI are some of the symbols that you need to look for. Think about ETF’s as a bird’s nest. And in that bird’s nest are companies such as Apple, Tesla, JP Morgan, Bank of America, Exon Mobil, Etc. Each ETF is weighted differently. Some are tech-heavy, some are leaning towards more consumer discretionary. But the good thing about ETF’s is that they are already managed by somebody, which makes having a financial adviser really not that of a necessity. Let me show you some historical data charts that justify how well these ETF’s have performed in the past. Remember, 10-15 years of horizon gets you a long way, in terms of growth and returns.

$SPY Chart 1996 to 2025

$QQQ Chart 2000 to 2025

$VOO Chart From 2011 to 2025

$VTI Chart 2002 to 2025

Like I said, these ETF’s have proven the test of time and are normally up trending. Having a 10–20-year horizon will surely help you out a lot in terms of your investment returns.

High Dividends, No Growth REIT’s

REIT’s or Real Estate Investment Trusts are companies who operate with one purpose in mind, and that is, to disperse revenue to its shareholders. Investing in REIT’s is the perfect way to get into real estate investments without physically investing into one. Think of it as a digital investment where you don’t have to worry about any labor involved, no carpenters needed, no plumbers, etc. Somebody does these things for you and they just give you a portion of the profit through dividends.

This is my personal favorite. Mind you, these are not growth stocks, prices are not going to soar from $10 to $900 in 10 years. Nope. They’re going to stay where they are and not fluctuate much. But what they’re good at is their amazing DIVIDEND yield that you can automatically reinvest to create a snowball effect. The dividends that you earn on a monthly or quarterly basis will create more children, and those children will create even more children. My favorites are $ARI and $AGNC. $ARI is a huge company, having to manage. $60B in assets when I last checked. This company gives 10-12% a year in returns. $AGNC is a smaller company based from Maryland. They give 14% returns annually, dispersed on a monthly basis. I personally have AGNC in my portfolio and I receive $0.12 cents per share that I have. I just reinvest them and would look at pulling them out until I turn 60.

Market Leaders That Are Too Big to Fail

When you look at sectors, you always need to choose the leaders within that category. For example, Tesla in EV’s, Apple in tech products, $META for AI technology, Nvidia for semiconductors, FedEx for courier service, Mcdonalds for food. These are all market leaders, and they pretty much are in charge of where to set sail and bring along with them the smaller players. These companies are so huge that they can go on perpetually, with proper direction (of course, not 100% of the time). These are stocks that you hold on to long term and expect to grow higher and higher.

The best way to go about these stocks is to do your own research. See what catches your attention and if you believe or have a gut feeling that they can make a difference or disrupt the sector that they are in, then invest while they are still undervalued.

I tell you that just by having ETF’s and REIT’s, you can be set for life, as long as you are consistent with investing. Think of a 30 to 40- year horizon.

________

Investing in Precious Metals

I love investing in precious metals not because of how much they go up in value, but because you can actually hold them and play with them. Hahahaha. The amazing thing about precious metals is that you can even have a jeweler melt it for you and turn it into jewelry, sell it and profit instantly.

I have fond memories of my grandfather going to his friend’s jewelry store. He pulls out a couple of gold nuggets each weighing about 6 to 8 oz and gets paid in cash after. What a convenient transaction.

As a beginner investor, start with silver coins. collect 1 oz silver coins then eventually move up to 10oz and 1kg bars. Then, if you can afford gold, then do the same thing. Precious metals are accepted by banks as collaterals; you can loan against the value of your collection. Let me make that clear.

Banks and large institutions still consider gold and silver as reserve currencies. In the event of a recession and when the dollar is weaking, pay attention that gold, if not most of the time, rise in value. When there is fear in the markets, big money retreat to gold as a safe haven, protecting their hedge.

You can get a loan from the bank and show them your gold coins, turning them into collaterals so that you don’t have to pay anything upfront and they won’t have to worry how you can pay off when things go south in order to get that loan. It’s one of the things that rich people do. If they want to get instant funding for something, they use their assets as collateral until they pay off the loan.

Go to your local coin shop or buy online, over at JM Bouillon. I don’t have any affiliation with them, so don’t worry. I’m not making a dime from you. What I have been doing is to buy monthly or quarterly using my credit card points that I get cash back from. Smart, right?

Let’s pull up the chart of gold.

Gold Chart 1974 to 2025

Silver doesn’t have drastic price fluctuations.

__________

Investing in Luxury Items *That Don’t Lose Value

This is the least of my favored investment type, but since my sisters are into this business, I can see how lucrative it can be. There is a lot of quick gains that can be made with this investment model. Certain brands maintain their value and some even gain more because of demand. Rolex and Hermes are amazing brands to start with. Daytona’s are in demand, Kelly and Birkin bags have been beating the S&P500 by lightyears, making between 300-500% returns. A Birkin bag is about $8000 to $10,000 and can fetch a price of $25,000 in the resale market. That’s amazing. So, chefs, try to snag a nice Rolex and enter the resale market and see where it takes you!

__________

Social Media

Of course, if you have the personality, the amazing face and quirky character, I see YouTube and other social sites to be a good active-passive investment. The moment you upload those videos and establish your presence, they become passive income and will forever pay you. Affiliations, future collaborations and even landing in Hollywood are all the byproducts of investing your time in social media. Unfortunately, I wasn’t gifted with a decent face, but I do have the personality.

__________

Purchasing A House to Build Equity

Recently, this has been a highly controversial investment. It used to be so accessible to purchase a house 20, 30 or 40 years ago. Today, a lot of people are saying it’s a nightmare to even own one. With ridiculous HOA fees, soaring house prices, expensive materials and labor for repairs and maintenance, and unbelievable property tax attacking you in all directions, you couldn’t help but to wonder, is it even worth it? Then again, ever since the pandemic happened, house prices doubled or tripled, but our wages didn’t move. An average executive chef’s salary has stayed between $90,000 to $120,000. In big cities where the talent is strong, then you can see anything from $120,000 to $200,000. But in NY for example, even making $200,000 feels like making $120,000 after all the taxes taken out of every paycheck. Twenty years ago, a chef can buy a house easily. But now, it’s impossible. Although, if there is a way for you to purchase one, then seize the moment and take advantage of owning a house.

You can’t deny the fact that owning a house in a good neighborhood is the fastest way to increase your net worth, at a cost.

__________

Once you have these things in place, then what you need to practice is discipline in saving money and investing. Follow the plan stated above and let the magic of money open its arms to you. Money shows its ways to those who deserve it.

Let me remind you about some key things:

Live within your means

Save at least 10% of your wages

Consult somebody who has the knowledge in the ways of money and at the same time, surround yourself with people who are better and smarter than you.

Invest, invest and invest no matter what happens

I hope this shines a light and help you with your retirement plan. I would be very honored and happy to meet you in the future, living comfortably while talking about how this article saved your life. Until then.

Have a good service, chef!